Counterfeit electronics are at best an annoyance to consumers and, at worst, a threat to national security.

Whether it’s an outright fake or a gray market device, the prevalence of counterfeit electronics is fueled by demand that’s not being met by the available supply, Roei Ganzarski, CEO of Alitheon, said in an interview with Fierce Electronics.

“Everything is becoming computerized,” he said, whether it’s cars, day to day devices or systems being used by the US Department of Defense. And when there’s a high demand that’s not being fully met, there’s more room for outright counterfeit chips, as well as gray market items, which might be a genuine chip that’s packaged as new when it has in fact been used somewhere else for several years, Ganzarski said. Although it’s a real chip, it may not perform as expected or required. “It doesn't have the reliability or the warranty and who knows what else is wrong.”

Putting gray market chips into systems is like turning back the speedometer of a car to make it appear there’s mileage on it, but it obscures the wear and tear that could have serious implications on the system it’s being used in.

Ganzarski said there’s always more demand than supply. “Sometimes it's worse, sometimes it's better.” He said that any chance a bad actor can find to make a dollar, they will take it. Even if the supply is meeting the demand, there’s an opportunity to make a profit offering cheaper counterfeit or gray devices to unwary customers looking to save money.

Fake electronics are more than an inconvenience

Anything transportation or government related needs to sound an alert for fake or grey electronics, Ganzarski said. “Imagine what happens if a fake chip goes into a plane? The ramifications go beyond financial penalties, brand perception or system performance, he said. “It's literally people's lives.”

Even if the performance is present in a gray market device, such as a chip pulled from another system, Ganzarski said, the risk is it whether it will perform as required at a crucial moment.

He said as the fraudulent electronics business grows, so have efforts to combat it, but what’s being done isn’t working, mainly because the approach is additive. “Take the microprocessors or the chips – I m going to add a hologram sticker on it to tell you it's real,” Ganzarski said. “I'm going to add a barcode sticker that you can read.”

These approaches are easily spoofed, he said, much like a fake ID that allows someone who’s underage to get into a bar. “That's why governments and airports do fingerprints, not IDs.”

Ganzarski said Alitheon’s approach to combating counterfeit electronics is applying fingerprints for all these electronic components in collaboration with chip and printed circuit board manufacturers.

Most alternatives to additive approaches require interaction with the chip to read a unique electronic signature, which is time consuming and not all that scalable, he said. “We would rather do biometrics.”

Detection tools must scale

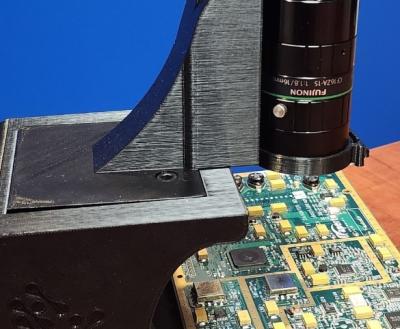

Alitheon’s proprietary solution enables it to use standard camera to capture and codify each device into a digital fingerprint, Ganzarski said. “We have found a way to fingerprint items without touching them, marking them, or doing anything to them.” He said it’s possible to differentiate each part out of a batch of millions. “The more samples or more items we have in the system, the better and better the results are.”

Palitronica, a Canadian company spun off from the University of Waterloo's Real-time Embedded Software Lab in 2019, is tackling counterfeit electronics by quantitatively assessing the quality and integrity of every part at a hardware level to spot hardware swapping, counterfeit products and board-level implants. The company was recently awarded $1 million (Canadian) in funding from Canada’s National Cybersecurity Consortium.

Unlike traditional assurance technologies that are resource-intensive, unscalable, and require supplier adoption or participation, Palitronica touts its Anvil hardware testing of components and assemblies as scalable, whether they have been procured or produced. Anvil is usually deployed end-of-line at the contract manufacturer.

Having control over as much of the production process as possible in one way to keep devices from being duplicated by those who want to flood the market with counterfeit copies. Anthony Le, vice president of marketing at Macronix America, which has a strong base of customers in the automotive market, told Fierce Electronics that the company recognizes the threat that counterfeit and gray parts pose to the broader chip industry, but that Macronix has an advantage over fabless chip makers because it owns its own fab.

“We have total control of the entire process of developing our non-volatile memory devices from design to final product,” Le said. Macronix, which includes its highly secure ArmourFlash memory line, offers block protection on most of its standard products. “These inherent security features will thwart attempts at cloning the devices."

Chip industry is more proactive

The US CHIPs Act to support more onshore manufacturing has been driven in part by the DoD’s interest in buying trusted and assured microelectronics, Geremy Freifeld, laboratory fellow with Draper, told Fierce Electronics.

Like Alitheon, Draper sees the counterfeit market showing up in the form of parts that have been pulled from other systems and represented as new with transportation and government systems being the most sensitive to bad actors, Freifeld said. “Government systems are actually a natural target economically, even if there's no malicious intent, because typically the government pays for significant amounts of upgrading that increase the cost of parts in general.”

He said the counterfeit phenomenon has become worse over the past decade because the supply chain is getting more dispersed and difficult to control, but the controls like those Draper has put into place have enabled the industry to keep pace.

The company is tackling counterfeit electronics through its systems engineering expertise for designing, developing and testing dynamic, “high assurance systems” typically found in government and defense environments that must be reliable and secure.

Roy Bishop, who leads business development at Draper, said its partners like Intel Foundry are looking to scale up their hardware assurance abilities to address the requirements of US military aerospace and government customers. He said Draper has a unique value proposition to share information between companies and governments.

The microelectronics ecosystem has also become more proactive by working across the value stream in phases, added Bishop, rather than be reactive by identifying a counterfeit part long after it’s been made. “Now we have trust by design and so we built that into the component, whereas before it might be an afterthought,” he said.