Ironically, the U.S. government just approved a massive influx of cash to boost domestic chip production in the CHIPS Act even as global electronics demand is in a downturn.

Of course, none of the fabs supported by the government largesse will be built and operational for years and by then consumer buying trends for smartphones, tablets and a range of electronics could have reversed the current market slowing. (And then have been up and down for many quarters to come.)

Still, it was distressing to read smartphone shipments declined for the fourth consecutive quarter in the second quarter, while tablet shipments were flat, and Chromebooks tanked.

The main culprit for lessening demand was inflation, but other factors impacting total shipments included a war in Ukraine and supply shortages due to continued restrictions in China due to Covid. For analysts forecasting electronics, the market and supply chain is truly global, not regional, and certainly not dependent on what happens in the U.S. alone.

The concerns spread beyond smartphones and tablets to adjacent electronics markets such as PCs, smart TVs and monitors, all of which are facing "much more severe reductions" which will last into the first half of 2023, said Ryan Reith, program vice president at IDC. "There is a good chance the PC market will be down double digits this year, and growing likelilhood it could also decline next year, yet by a smaller decline."

The global second quarter numbers for smartphones showed an 8.7% decline year over year, the fourth consecutive quarter of decline for the smartphone market, according to IDC. Total shipments were 286 million units, about 3.5% below IDC’s forecast.

Tablet shipments for the second quarter were flat, up by 0.15%, reaching 40.5 million tablets shipped, IDC recent reported. More dramatically, Chromebooks declined by 51.4% year over year in the second quarter, reaching 6 million devices. While the decline sounds dramatic, IDC noted that demand in the education sector buying Chromebooks has slowed and the total volume is still above pre-pandemic levels. (Remember, schools and parents and workers at home were buying up laptops and Chromebooks during the pandemic’s worst days.)

“While Chromebook shipments have trended down in the past few quarters, there’s still opportunity to be had as the pandemic has brought about positive changes to Chrome adoption,” Jitesh Ubrani, a research manager at IDC, said in a statement.

With the continued smartphone decline, the industry was in a supply-constrained mode earlier in 2022 and now has shifted into a demand-constrained market, said Nabila Popal, an IDC research director. “While supply improved as capacity and production was ramped up, roaring inflation and economic uncertainty has seriously dampened consumer spending and increase inventory across all regions,” he said in a statement.

Smartphone manufacturers have cut back orders for the rest of the year with Chinese vendors making the biggest cuts, Popal said.

Not so for Apple, however, at least according to a Bloomberg report, citing sources that say Apple has told iPhone assemblers in Asia to make 90 million smartphones in the rest of 2022 even as the overall market slows. The reasoning, apparently, is that affluent iPhone buyers will hang in there and upgrade their phones.

Demand for smartphones of all flavors is expected to pick up in some regions towards the end of 2022, IDC said. “We continue to believe that any reduction today is not demand that is lost, but simply pushed forward,” Popal said.

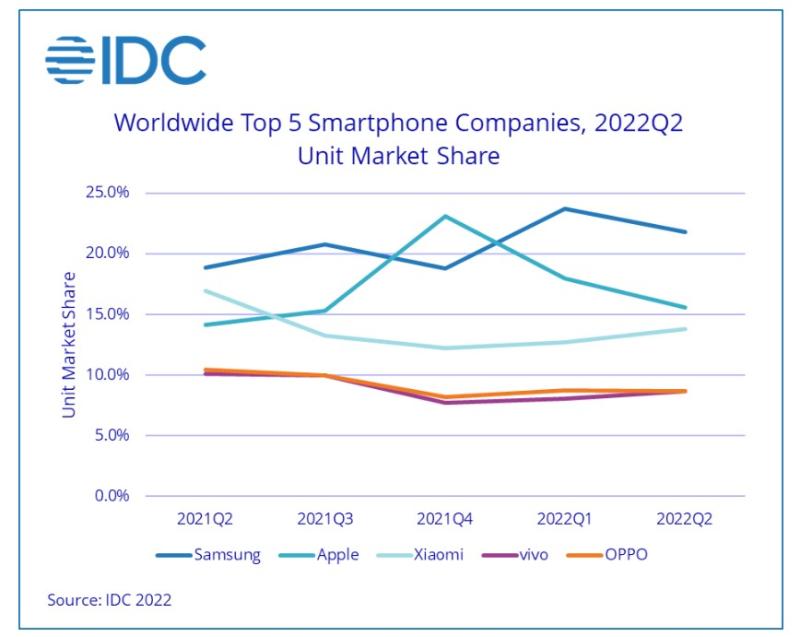

In the second quarter, IDC said Samsung led the global market with nearly 22% of the total market, while Apple finished second (15.6%), followed by Xiaomi (13.8%) and vivo and OPPO had a statistical tie for fourth (8.7% each).

RELATED: CHIPS Act marks a vital first step