Sales of chips globally in October dropped 4.6% year to year, the worst decline since December 2019, according to stats collected by the World Semiconductor Trade Statistics group.

The results were more positive for October sales into the Americas, which jumped by 11.4%, while sales into China declined by 16%.

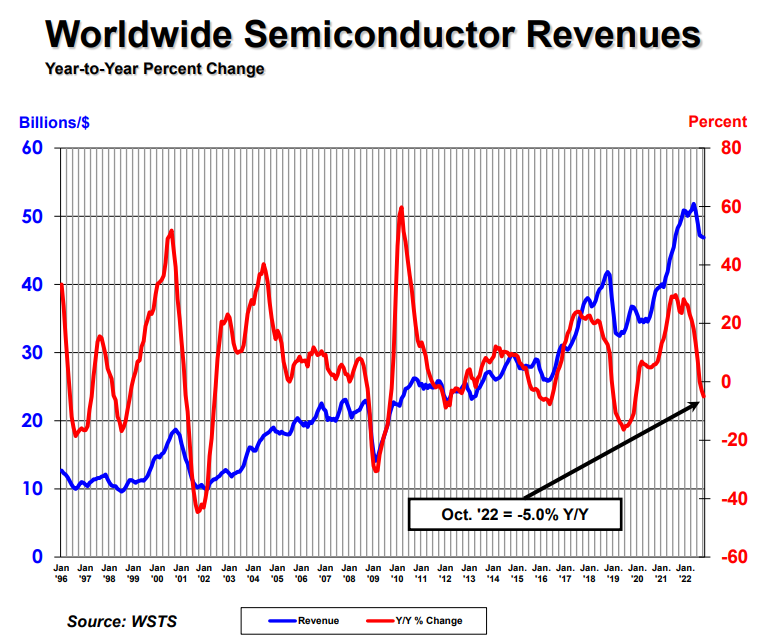

October sales globally reached $46.9 billion, slightly down from September’s sales of $47 billion and 4.6% below October 2021 sales of $49.1 billion. WSTS compiles monthly sales based on a three month moving average, which were down 4.4% for August/September/October when compared with May/June/July.

WSTS data shows global quarterly sales topped $50 billion for the first time in early 2022, but began to decline in June to the October level of $47 billion. Revenue projections have caused several chipmakers to begin to make cuts, although it is not clear how many jobs might be affected so far.

OEMs that make PCs, smartphones, servers and other electronics have reported demand declines, but certain types of chips are still in high demand and production runs vary. Some OEMs making vehicles must still wait a year from the time of ordering chips until receiving them.

The PC market, hit especially hard, is absorbing the build-up of purchasing that occurred in the pandemic as the work from home trend exploded followed by reduced PC purchases two years into the pandemic. In similar fashion, data centers and cloud providers have put some server purchasing on hold after a strong pandemic build up.

Even smartphones, considered the highest priority for consumer electronics spending, have seen a 9% decline in global shipments throughout 2022, according to IDC. The firm expects a recovery mid-year 2023.

RELATED: ‘Tough situation’ for smartphones, not expected to recover until mid-2023, IDC analyst says

The situation for chips used in new vehicles is more complex, because interest and sales of electric vehicles are robust, especially in China. There are also still 12 month delays in some cases to receive orders for power chip modules.

Historically, chip sales globally in 1996 were about $10 billion with several wide swings in successive years including steep declines in 2001, 2009 and 2019. The steep declines have been followed by steep increases a year or two later but fluctuations have been dramatic.