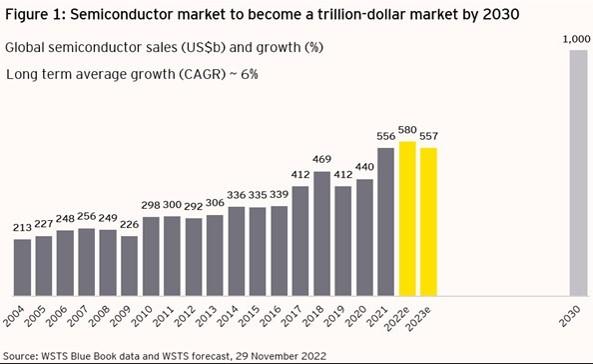

For semiconductor companies, accustomed to volatile and hard-to-predict demand cycles, these are interesting times. Overall customer demand for the electronic chips that help run everything from electronic toys to jet fighter avionics is mixed, depending on the product segment. In the long term, market growth is expected to resume its decades-long boom and reach US$1 trillion by 2030 (Figure 1.)

Key demand observations

• The industry recorded strong growth during the pandemic (26% in 2021), driven by work-from-home and the digital transformation of enterprises.

• The steady digitalization of all things electric will continue to drive long-term demand for semiconductors.

• In the short term, the industry is likely to follow a cyclical pattern influenced by macroeconomic growth cycles, inventory trends, manufacturing capacity issues and price fluctuations.

• Slower growth of 4% is expected in 2022 due to ongoing demand and price increases caused by supply chain constraints offset by economic trends. For 2023, the global semiconductor market is projected to decline by 4.1%.

Over the past six months, there has been a consumer spending slowdown due to rising inflation and interest rates that are impacting sales of electronics, appliances and the like. Semiconductor makers are coping with excessive chip inventory and production capacity as demand weakens for items such as smartphones and PCs. In response, some foundries, including Taiwan’s largest fabs, have reduced capital spending due to slowing global chip demand, rising costs and delayed tools shipments.

However, while some sectors are dragging, others have momentum. The long-term trends behind the growth in the electronics market are still forecast, with rising demand expected from growth areas such as Internet of Things (IoT) and Electric Vehicles (EVs). Other persistent trends providing continued appetite for chips include automation, artificial intelligence (AI) (for example, driverless cars), data storage, and blockchain technology, as well as the inexorable rise in the number of chips used per device.

Integrated device makers (IDMs) and foundries, like Intel and Micron, are responding with long-term capacity expansion plans to build new fabs in the United States, supported by Creating Helpful Incentives to Produce Semiconductors and Science Act of 2022 (CHIPS Act). European IDMs — for example, STMicroelectronics — have their eye on the automotive market and are planning to invest in production to bridge the demand and supply gaps.

Capital allocation is a challenging process in this environment. While it’s not surprising, in an industry as complex and multifaceted as semiconductors, that conflicting market signals would produce different strategic responses, there are strategies that companies can adopt to limit downside risk and increase the chances for success. Companies that combine short-term adjustments with a steady, long-term growth strategy are likely to succeed.

Strategies companies may need to consider in challenging times:

1. Continue to spend on R&D – Companies can continue to spend on the development of next-generation process technologies and devices, to maintain a competitive edge for the next phase of market growth. Technologies such as AI, IoT, edge computing, vehicle electrification, autonomous driving and data analytics will drive the next demand cycle.

2. Focus on short-term operating expenses – Chip makers can undertake a strategic cost assessment and consider cost-cutting measures to protect margins and cash flows. They can also review working capital considerations and redirect expenses from mature product categories to growth areas, such as autos or IoT.

3. Implement initiatives to optimize supply chain – Investment options can include strategies such as supply chain diversification to reduce geopolitical risks and strengthen supply chain resilience, and near-shoring to bring supply chains closer to customer markets.

4. Maintain capital allocation on fabs – Companies can continue to invest in fab facilities and take advantage of both federal and local incentives, including tax breaks in the United States and Europe designed to bring overseas fab investments onshore.

5. Reduce expansion risk with partnerships – Many semiconductor companies have succeeded in modulating capital investments in complicated economic environments by emphasizing partnership relationships. Companies that develop joint ventures and financial partnerships with organizations that enhance technology or special market access can stay abreast of markets without overcommitting massive investments in the short term.

6. Product portfolio diversification through acquisitions – Companies can shift their concentration from a limited set of markets and customers to a broader product portfolio and into adjacent markets. Strategic acquisitions can help accelerate diversification and gain market share.

It’s clear that the global semiconductor sector will be going through another year of transition in 2023. Chip manufacturers need to stay the course and invest in growth. Management’s need for information will increase, because the risks from financial volatility, supply chains and trade remain elevated in the short term.Companies may need to continue longer-term investments in fab expansions and seek strategic joint ventures and other partnerships to reduce risk.

Ronald Hofmeister is a partner for EY-Parthenon, Ernst & Young LLP. Contributors are Michael Y Tsai, EY-Parthenon, and Alex Chung, EY-Parthenon. Views are not necessarily Ernst & Young or other members of the global EY group.