Self-driving vehicles will arrive in substantial numbers in various global markets at some point. Predictions on timing range from just around the corner to, well, decades in the future, depending on the expert.

For companies supplying lidar components to big carmakers such as GM, the forecast for autonomous vehicles is more nuanced and based on hard realities honed through hundreds of tests of components and practical validations.

“Six years ago, everybody thought fully autonomous vehicles were right around the corner and will be everywhere. We never believed that,” said Dr. Jun Pei, co-founder and CEO of Cepton, a maker of lidar used in everything from casinos to smart cities to GM Ultra Cruise models appearing in 2023.

“Level 3 autonomy will happen before Level 4 and we’ll soon start at Level 2-plus,” he said in an interview with Fierce Electronics. “I believe the big pipe dream of Level 4, the process of having automated robot cars, will go through an evolution process. You need to get to level 3 first and have a safety record. If you get an autonomous vehicle, your safety level has to be better than a human driver…

“So we’re quite a number of years away [from Level 4 autonomy] to demonstrate this is a valid path and we’re hopeful the industry will not take too long. It’s not decades, but probably years,” Pei added. “It’s a slow grinding process.”

If his thinking sounds cautious, Pei is nonetheless buoyed by how Cepton has performed. As a startup in 2016 in San Jose, California, it won the GM Ultra Cruise contract in 2019 and now has more than 160 engineers on board. Even in 2019, the forecast was to put Cepton lidars behind the windshields of Ultra Cruise vehicles by 2023 and remains on track. It has now reached the coveted D sample phase, a production phase that deems the lidar design valid enough for use in thousands of sellable vehicles. “We’re heavily into execution,” Pei said.

Earlier this year, Cepton launched an IPO at $10 a share, with the stock trading at $1.69 per share as recently as Wednesday. However, a low share price doesn’t mean much to Pei because he knows working with Ultra Cruise at launch next year will be a boon to his company.

“We’re undaunted by the current stock price,” he said. “The focus for the company is execution and we want to make sure we have Cepton in Ultra Cruise. I’m a firm believer in the value.”

Plus, the IPO has “made us known, giving us additional funding wins,” he said. Cepton has evolved from a startup just a few years ago to a “very established engineering enterprise,” Pei said. “We’re still a startup in working style with the mentality of each person that the sky is the limit.”

Cepton (an amalgamation of ‘perception’) won the GM contract prize on low cost, taking advantage of a partnership with Tokyo-based Koito Manufacturing, which has been in business for more than a century. That partnership has made Cepton relatively supply chain resilient in a sea of un-resiliency. “Koito knows how to manage the supply chain and has negotiating power to drive everything from chips to other components,” Pei said. “They are a tremendous anchor to have the supply chain under control.”

Beyond producing lidar technology that works, cost is everything to the OEMs, he said. “Lidar is a simple process of measuring distance, but there’s an elaborate process for amplification, digitization, calibration,” he said. “In the first meeting with an OEM you discuss lidar range and resolution for 10 minutes, but then it’s all about cost. If you are $1 more than the competitor, you are out the door. We captured a huge element in the cost.”

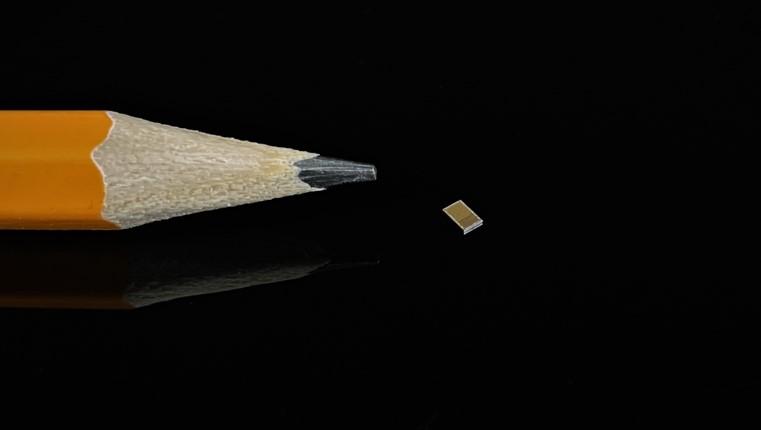

Another critical part of lower cost for Cepton was its self-designed ASIC with an Arm core inside that is smaller than a sesame seed, Pei said. Patented Micro Motion Technology is the crown jewel behind the tech.

(Cepton)

Cepton also helps GM with a lidar behind the windshield (nestled behind the rear-view mirror), because many windshields have a similar shape that means the lidar can be used in different vehicle models. “Having the sensor there makes the tech transferrable from platform to platform,” he added.

Several years ago, a single lidar device would cost tens of thousands of dollars, but the price tag has now dropped to a few hundred dollars. Its main benefit is high resolution, offering the ability to see a white vehicle against the backdrop of a white sky to help a vehicle avoid a collision. “First and foremost, lidar is for safety,” he said, which is why major OEMs like GM, Volvo and BMW are using it. Out of hundreds of lidar manufacturers, Cepton competes with a mere handful of lidar providers who have won major OEM contracts: Luminar, Innoviz and Valeo. (To improve perception, GM’s Ultra Cruise relies on a sensor fusion approach of cameras, radar and lidar.)

OEMs are hoping lidar will help reduce accident rates drastically, perhaps by 90%. If a carmaker can get that level of safety improvement for a few hundred dollars it is worthwhile, he believes. “It’s a no-brainer,” he said.

By contrast, Elon Musk and Tesla engineers have held firm to the belief that lidar is not needed and far too expensive when radar and camera sensors will suffice. Musk made his first no-lidar pronouncement 15 years ago.

“He can’t walk that back,” Pei said. “He’s cornered himself.”

RELATED: GM shows new Chevrolet Silverado EV to appear in spring 2023