As US Treasury Secretary Janet Yellen travels to meet top government officials in China this week, the status of trade relations between the US and China in recent years has never seemed more tense.

“The rhetoric is definitely not getting better,” said Leonard Lee, an analyst at Next Curve via email to Fierce Electronics. “The two countries find themselves in an incrementally worse place…The rhetoric and the cycle of retaliatory policies between the two nations could certainly get worse as China continues to put its cards on the table.”

Treasury released a vague statement about the purpose of the trip without further details: “We seek to secure our national security interests along with those of our allies and to protect human rights through targeted actions” as well as seeking “a healthy economic relationship with China that fosters mutually beneficial growth and innovation and expands economic opportunity for American workers and businesses.” Finally, Treasury added: “we also seek to cooperate on urgent global challenges like climate change and debt distress.”

Also, Treasury did not admit to direct concerns about recent China sanctions imposed Monday on exports of two rare metals, gallium and germanium, used in computer chips and solar panels. However, those China sanctions did catch the attention of trade and industry analysts.

The new China export controls on gallium and germanium put several semiconductor companies at risk, including Wolfspeed, the top supplier of materials for gallium nitride, and Qorvo, NXP Semiconductors and others buying GaN from Wolfspeed, according to Wells Fargo investment analyst Gary Mobley. GaN is used in silicon carbide production.

The China sanctions take effect Aug. 1.Lee called China’s move “an undesirable eventuality” in increasing escalations between the countries.

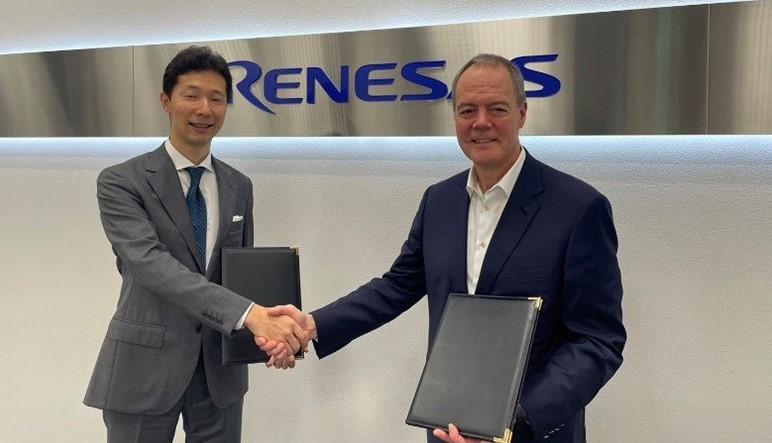

Separately on Wednesday, Renesas announced it is depositing $2 billion to secure a 10-year supply commitment from Wolfspeed for silicon carbide wafers to allow Renesas to produce SiC power semiconductors starting in 2025. The $2 billion will support Wolfspeed’s capacity construction, including the world’s largest SiC materials factory in Chatham County, NC, where mostly 200 mm SiC wafers will be made.

Notably, the China restrictions on gallium and germanium will not affect the deal between Renesas and Wolfspeed because neither metal is used for SiC production, a spokesperson for Renesas said in an email to Fierce Electronics.

Qorvo makes GaN RF products and specializes in gallium in combination with arsenide products for RF. Germanium is also combined with silicon for processors used in RF-front end products for smartphones, which would affect Qorvo, Skyworks, Qualcomm and Broadcom.

NXP said in a statement it is reviewing the China restrictions, but Wolfspeed and Qorvo did not respond to a request to comment. Navitas Semiconductor reacted to the Chinese sanctions with a press statement saying it has confirmed a continued supply of leading edge GaN power integrated circuits.

“Navitas does not expect customer deliveries to be impacted or its business to be adversely affected by the export restrictions,” Navitas said. The company also asserted significant sources of gallium are available worldwide, because it is a natural by-product in production of aluminum and other metals. The Critical Raw Minerals Alliance says China produces 60% of the world’s germanium and 80% of the world’s gallium.

President Biden and a majority of the members of Congress have raised concerns in the past two years over China’s dominant position in mineral supplies. The US imposed export limits on semiconductor manufacturing equipment supplied to Chinese companies last year and the Netherlands followed suit, under pressure from the US. The rationale for the US move restricting fab equipment was to prevent companies in China from making and selling advanced chips to Russia and other countries that the US considers to be security threats.

RELATED: How chip executives react to US trade sanctions on China

Making the China-US trade debacle more tense, the Biden administration is weighing the possibility of requiring cloud providers like Azure and AWS to seek government permission before serving Chinese companies seeking to train AI models, according to sources quoted by The Wall Street Journal.

Much weighs on Yellen’s visit this week, as the trade relationship with China remains fraught. “Both sides would probably like to establish a win-win situation and dynamic across the board from trade to national security, " Lee added. "One thing is becoming apparent: escalation and retaliation will create mutually assured detriment for the semiconductor industry and tech/electronics as a whole.”

Jack Gold, an analyst at J. Gold Associations said China has not been a good trading partner for several years, but said diplomacy will matter. “While it’s clearly important for the US to keep the conversation going, with hopes the Chinese may change, it’s not likely in my opinion. The downside of US restrictions is that the US is forcing the Chinese to grow their own leading edge tech, but it’s not clear if they are able to keep up with the rapid pace of development in the West."

Gold concluded, "US and China have a lot to lose if there is a real and protracted trade war, so diplomacy will be very important to keep that from happening."