The semiconductor industry is arguably the world’s most important industry and TSMC the most important player in that industry.

Most important, partly, because of geography – it is based in Taiwan—and partly because it is making the most advanced chip nodes used in the world’s most sophisticated computers and smartphones. Apple, Nvidia and AMD are major customers.

TSMC's place in geopolitical history

Also, TSMC is vitally important, sadly, because Taiwan could be invaded by China in coming years. Catastrophic projections shared by multiple analysts envision US special defense forces, in the event of a China invasion of Taiwan, quickly being deployed to remove or destroy TSMC’s valuable chipmaking equipment, some of it the size of large houses plunked down inside enormous clean rooms. The reason? Just to keep China from possessing and using the multi-billion-dollar and often proprietary machines.

TSMC’s vulnerability was a big reason for the bipartisan support of the US CHIPS Act, which passed and is being implemented slowly but has prompted major private investment in new domestic fabs. Even so, it will take years for fabs supported by the CHIPS Act to be fully functioning in the US (along with similar developments happening in Europe).

US politicians, including President Biden, and business leaders are spending time holding press events praising the CHIP Act for prompting investment, but nobody is willing to say how far off-course Western countries went for decades in sending chip fab and assembly work to Asian countries. Perhaps nobody expected China to want to invade Taiwan or commit human rights violations. Or perhaps industry officials decided it was just too hard to make chips affordably in the US , while separately, US companies wanted to benefit from Chinese talent and IP? Chip CEOs and trade groups don’t like to talk about such things.

TSMC's Q1 numbers

Given all this history, it is disturbing to read TMSC’s latest Q1 earnings report posted Thursday, showing revenues down to $16.72 billion, nearly 5% below the same quarter a year ago. Worse, TSMC guidance for Q2 envisions revenues that are nearly 15% below a year ago.

“Our first quarter business was impacted by weaking macroeconomic conditions and softening end market demand, which led customers to adjust their demand accordingly,” said TSMC CFO Wendell Huang in a statement.

“Moving into second quarter 2023, we expect our business to continue to be impacted by customers’ further inventory adjustment.”

SemiAnalysis chief analyst Dylan Patel noted distressing signs at TSMC, including signs of weakness in automotive chips, which he called “the last holdout of strength in the market.”

Patel and others see what happens to TSMC as a means of reading the global semiconductor industry pulse. “While many other companies can help give signs and indications, no one else is quite in the center of it all, like TSMC,” he said.

TSMC CEO C.C. Wei reported automotive demand is now holding steady for the company, but is “showing signs of softening into second half of 2023.”

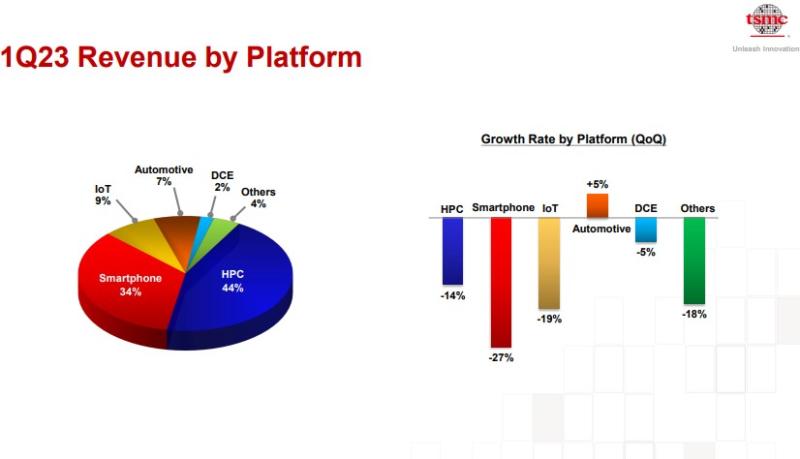

Also, high-performance computing chips grew to 44% of the company’s revenue, but fell 27% (by $1 billion) from the prior quarter. Smartphone chips declined $1.8 billion for the quarter.

Growth rates slowed for every category other than automotive in the first quarter compared to the previous quarter, with smartphones down by 27% and HPC down by 14%, TSMC indicated in a slide presentation.***

Patel’s most serious concern came over TSMC’s declining manufacturing plant utilization rates, an indication of how much the business is using of its available resources and machinery capacity. TSMC has been enjoying 100% utilization rates since the start of Covid, but Patel added, “now the picture isn’t so pretty.”

The company’s 7nm chip node utilization rates fell below 70% in Q1 and are projected to fall below 60% in Q2 on weakness in smartphones and PCs. (Experts consider 85% a suitable utilization rate for most manufacturing firms.)

TSMC in Arizona

TSMC has announced plans for a $40 billion chip fab in Arizona and has faced permitting problems, but is still on track to produce chips on its N4 process in late 2024. Costs in Arizona are “definitely higher than in Taiwan,” Patel noted, adding that TSMC believes the Arizona location “provides value to customers…This means customers are willing to pay more per wafer if it comes from the US fab.”

RELATED: TSMC to build second Arizon plant for 3nm process

During the earnings call, TSMC also said it was stopping plans for 28nm capacity at a Kaohsiung fab in Taiwan, which is being adjusted instead to make a more advanced node. The company is likely worried about an oversupply of 28nm, even though it is considering a 28nm plant for Europe for automotive applications, atop of one built in Japan and an expansion of 28 Nm capacity in Nanjing, China.

Despite some disturbing Q1 news, things are not desperate at TSMC. The company mentioned to analysts it has received a huge order in the past week for an AI chip, with no other details.

Patel tracks carefully TSMC’s ramping of production for 3nm and 5nm chips and said the company is making “some quite heroic assumptions” for the last six months of 2023. Even so, Patel added, “TSMC’s full-year guidance means H2 is extremely strong. They are arguing that full-year revenue is down only low to mid-single digits. If we take a conservative estimate of down 3.9% that lands full-year revenue at $72.92 billion. That doesn’t sound too crazy on a full-year basis.”

TSMC shares up 16% ytd despite Buffett

TSMC shares dropped 3.5% on Friday to $86.80 at noon ET. Shares have been up 16% year to date, an indication of confidence despite a widely publicized decision by Warren Buffett’s Berkshire Hathaway to sell off $3.7 billion in TSMC stock in February after a big purchase the prior fall. Buffett recently told the Japanese news agency Nikkei that geopolitical tensions were “a consideration” in making the sale.

China claims Taiwan as its own territory but TSMC is still widely viewed as part of a group of silicon companies located there that together make up a theoretical “silicon shield” against a potential military invasion by Beijing.

Indeed, as Patel said, TSMC sits at the center of it all.