When CEOs almost blithely mention “macroeconomics” as a cause for a bad quarter lately, they are almost surely summarizing dozens of indicators, none the least of which includes lagging consumer interest in purchasing electronics.

One principle concern is consumer demand for smartphones, which are now expected to be significantly worse in 2023 than IDC analysts forecast last year.

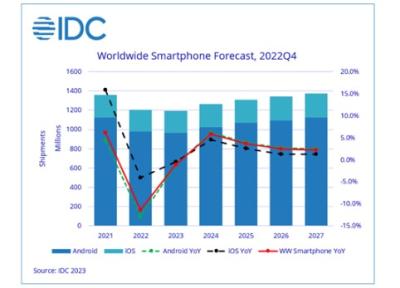

On Wednesday, IDC reversed its earlier forecast for 2.8% growth in smartphone shipments to a decline of 1.1% for 2023, a shift of nearly 3 percentage points. IDC couldn’t avoid blaming the slide on “macroeconomic challenges” and weak demand, but whatever you call it, the situation is not good.

Real market recovery is now expected to occur in 2024, which will be up by nearly 6% over 2023, then followed by low single-digit growth for a five-year compound annual growth rate of 2.6%.

Even the recent reopening of China hasn’t helped matters. “There is still a lot of uncertainty and lack of trust, which results in a cautious outlook” on the part of smartphone makers, said Nabila Popal, research director with IDC. Popal nonetheless called the challenges “short-term,” noting the significant pent up refresh cycle in countries such as the US and those in Europe.

The first half of 2023 is going to be the worst, with double digit declines, followed by a turnaround in the third quarter and double digit growth in the last quarter. An influx of premium smartphone models often launched in the second half will keep the full year decline from being worse, noted Anthony Scarsella, an IDC research director.

IDC said 5G smartphones are still gaining steam and will make up 62% of smartphones shipped in 2023, then reach 83% by 2027. Foldables are expected to grow to nearly 22 million units, a 50% increase. Multiple Android foldables launched at MWC 2023, IDC noted.

Possibly most important to consumers, average selling prices will begin to decline in 2023 and reach $376 by 2027, down from $415 in 2022. The ASP for all smartphones in 2019 was $334.

IPhone shipments won’t see as big a decline in 2023 as Android phones. All Android phones will see 967 million shipments in 2023, down 1.2% over 2022, while iPhone shipments will reach 225 million, down 0.5%.

RELATED: Qualcomm handset revenues dive 18% with ww smartphone decline