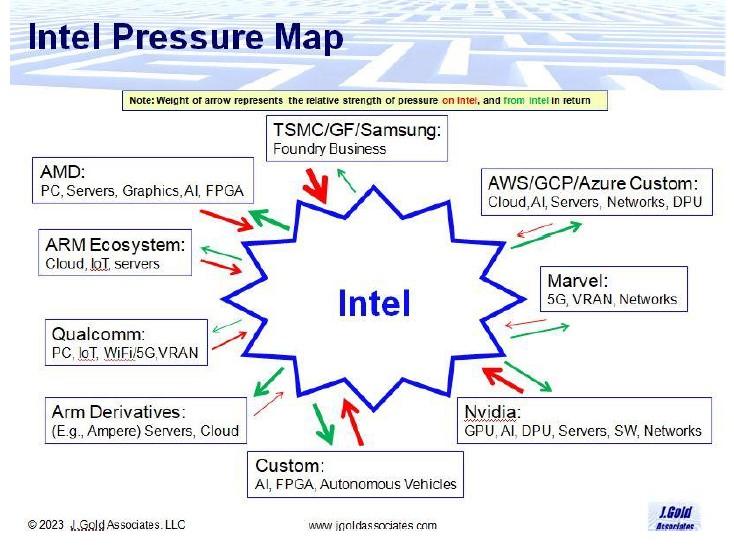

Intel continues to face some stiff competition in many of its markets. And it faces a number of competitive "threats" to its business. Below is a brief overview from our research showing a "Pressure Map" of the areas (and some competitors) pressuring Intel. But there are also several areas where Intel is placing a good amount of pressure on its competitors.

The arrow weights represent a relative amount of pressure. Red represents pressure on Intel and Green represents pressure from Intel.

Below is our analysis of various market segments and Intel’s position in them:

PC – Intel faces increasing pressure on its core PC business from AMD with an increase in AMD market share from its competitive processors. We also expect an increase in ARM-based Windows PCs, primarily powered by Qualcomm Snapdragon chips that also include 5G connectivity as a primary capability. However, we don’t expect a large percentage of PCs to be deployed in enterprises that are ARM based, as full compatibility of all apps and services is not guaranteed. The biggest short-term potential is likely pro-sumer.

Data Center – There is increasing pressure on Intel from primary competitor AMD from increased market share with high performance server chips. There is also a push by ARM-derivative CPU providers (such as Ampere) to try and capture data center and hyperscaler deployments based on the expected improved power/performance needed. Since power cost is a major consideration, there is the potential to have a market impact. Indeed, all the major hyperscalers (AWS, Azure, Google Cloud) are creating their own ARM-based data center chips to offer a lower cost option for specific workloads. But we don’t expect a major impact on Intel and x86 processors.

AI – This is perhaps the most visible area that Intel faces pressure from, primarily from Nvidia that has captured a commanding portion of the AI market. But AI is a very broad area, with many areas in which to excel. While Nvidia holds a majority share of the high end training market for AI/ML and NLM, the need for inference-based AI is potentially many times larger. That is where Intel still holds a major advantage with AI accelerated CPUs. And with a renewed interest in high performance GPUs, Intel is pushing back in training models as well. Finally, Intel’s Habana acquisition provides it with a custom AI chip (Gaudi) that increases the performance and lowers the power for many AI processing tasks, and is highly competitive with Nvidia’s A100 family. Intel will capture a significant share of the overall AI market even while the low end will be better served by AI embedded accelerators in ARM-based systems (such as Qualcomm, MediaTek, Broadcom).

IoT – This is a vast marketplace and much of the activity to date has been focused on intelligent devices like security cameras, smart sensors for vehicles, smart consumer device, etc. In these markets, ARM dominates with its low power approach to computing. It’s unlikely Intel can compete at the low end, but can compete in higher end IoT devices where compute power is critical (such as high end health appliances). Because the potential IoT market is so broad, Intel can still capture a significant share.

Edge – Intel has one major advantage at the edge. Since much of the edge deployments will center around running reduced versions of enterprise software, being fully x86 compatible can go a long way to accelerating the path for moving apps to the edge. Nevertheless, it faces stiff competition from ARM-based servers that are already powering mobile edge computing systems. But the Edge market is massive and Intel will capture a significant portion, including edge systems deployed by hyperscalers.

Telco – As network operators have moved to a fully virtualized environment, Intel has benefitted from being an early provider of key virtualization frameworks (e.g. FlexRAN), and has captured the vast majority of virtualized core network processing. With its newly developed Xeon with vRAN Boost SoC, it has effectively eliminated the need for standalone network cards. However, Intel still faces a formidable threat from ARM-based suppliers (such as Qualcomm, Marvel, MediaTek, Broadcom) that have made VRAN and ORAN high priorities for market expansion.

Software – Intel has been producing quality software for many years and has made important contributions to many industry initiatives. But most of its efforts in the past were in engineering systems (such as compliers). While it does have some significant platforms (such as OpenVINO as part of OneAPI), it will have a lot of work to do to be perceived as a competitive enterprise level software provider. But this are does represent a revenue growth area, if Intel can be successful (unlike several unsuccessful attempts in the past).

IFS – This is perhaps Intel’s newest and most difficult bet on its future. It has lagged behind in process technology, and over the past couple of years has been aggressively pursuing a “catch up and surpass” strategy. By opening its production facilities to outside chip companies (something it had done only rarely in the past), it hopes to capture a recurring revenue stream and help fill its increasingly expensive fabs. While it has signed some high profile companies (such as MediaTek), it remains to be seen how competitive it can be against TSMC, GlobalFoundries, Samsung, and others.

Bottom Line: Intel faces a number of challenges that are pressuring it to react to maintain or recapture market share. We believe that Intel has been shaken out of its complacency and is effectively pushing back in a number of key areas. While it might take a couple of years before all of its efforts are realized, we believe Intel is in a better position now.

Jack Gold is founder and principal analyst at J. Gold Associates, LLC. With more than 45 years of experience in the computer and electronics industries, and as an industry analyst for more than 25 years, he covers the many aspects of business and consumer computing and emerging technologies. Follow him on Twitter @jckgld or LinkedIn at https://www.linkedin.com/in/jckgld.