The massive market inflection toward EVs and AVs has led Intel Foundry Services (IFS) to form a dedicated automotive group to deliver that sector a complete set of chips and related tech, Intel announced Thursday.

“Automotive is going through a transition to autonomy and electrification,” IFS President Randhir Thakur said in a recorded session at Intel’s 2022 Investor Meeting. “To serve this market, there will be a dedicated automotive group within IFS.”

IFS will provide products in three areas: automated and assisted driving, RF and sensors< and power management. “We will provide open compute and allow OEMs to differentiate with their own software,” Thakur said.

The total market opportunity for premium automotive semiconductors will be $16 billion in 2030, of which IFS said it could address 80% of the market. Intel has about 4% of the auto bill of materials (BOM) for automotive today and wants to reach 20% by 2030.

Intel plans to provide Intel 3 semiconductors into the auto market and specialty chips from Tower Semiconductor, which Intel announced plans to purchase in the next year for $5.4 billion. Intel will also be able to provide its lidar sensing products to auto OEMs. MobileEye is considered an anchor partner in the dedicated auto group. Intel is hoping to take MobileEye public later in 2022.

The open auto compute platform will allow OEMs to build with chiplets and other packaging flexibility. In that sense, IFS is offering a similar approach to Nvidia’s Drive capability which is being used by OEMs to build custom applications on top. Nvidia announced recently that Jaguar Land Rover is one such customer.

RELATED: Jags and Land Rovers will get Nvidia automated drive tech in ‘25

Across all of IFS, the Intel division will primarily service compute, mobile and auto customers, serving a total market of $180 billion in 2030. Revenues for IFS, which was created in March 2021, were $800 million, while Tower revenues were about $1.5 billion.

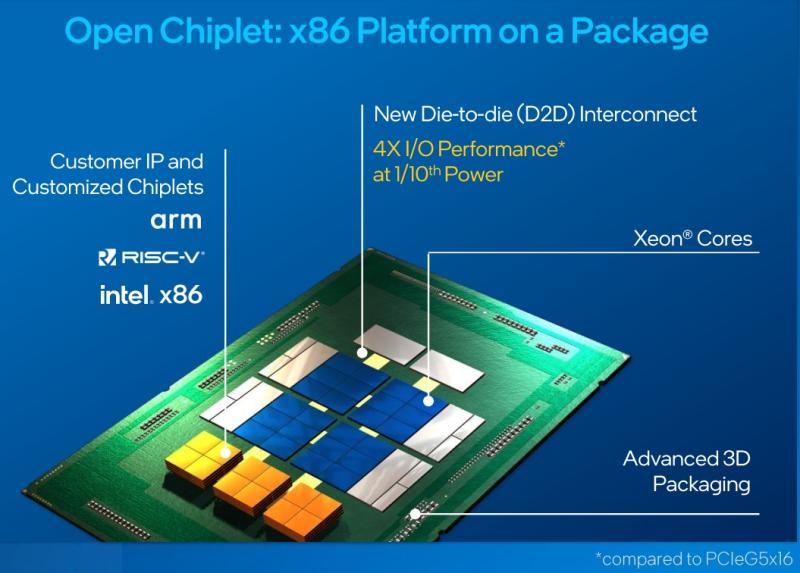

CEO Pat Gelsinger has described Intel chiplets as key to IFS growth in addition to the new automotive group. On a single board, chiplets are modular, like Legos, each with a different function, Thakur said. Chiplets can vary in customization, based on Arm, Risc-V and Intel x86, working alongside Xeon cores. They will serve the market opportunity for what Intel describes as a “data center megatrend” in accelerators to serve AI, media, high performance computing, networking and storage.

Elsewhere at the Investor Meeting, Intel introduced Arctic Sound-M, a media supercomputer GPU for data centers to support hardware-accelerated AV1 encode.

Intel also assured investors it remains on track to reclaim transistor performance by watt by 2025 amid stiff competition from Nvidia, AMD and others.