2021 was a record year for the global chip industry as revenues exceeded half a trillion dollars, $100 billion above the next highest year on record in 2018.

How was it possible for the industry to do so well, even as chip shortages were widely reported, especially hurting vehicle manufacturers? Global vehicle production actually increased in 2021, but only by 2.5%, while auto semiconductor revenues were more than $50 billion, up by 28% over 2020, Omdia said.

The answer for what happened is as simple as a 101 Econ case study: Demand soared for chips used in laptops and computers for work-from-home as well as data centers because of a little thing called a global pandemic. Meanwhile, supply shortages throughout the chip landscape resulted in rising average sales prices, which helped lift chipmaker revenue, according to a wide range of economists and analysts.

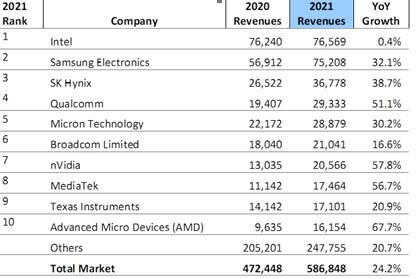

The resulting strong 2021 revenue of $586.8 billion for all chipmakers was 24% above 2020, “significantly above the historical average increase of 6.8%,” said Craig Stice, chief semiconductor industry analyst at Omdia.

Record revenues across the industry helped Intel stay in the top position for the year, although Samsung outdid Intel on revenues in the fourth quarter of 2021. Omdia reported Samsung’s revenues reached $19.995 billion in the fourth quarter, compared to $19.976 for Intel.

However, Intel saw $76.569 billion overall in 2021 revenues, compared to Samsung’s $75.208 billion.

The top two players in semiconductors far outpaced the rest of the field, with SK Hynix at $36.7 billion for 2021 and Qualcomm at $29.3 billion. Micron finished fifth at $28.8 billion.

Omdia called 2021 a “remarkable year for the industry” because revenues reached a record $586.8 billion while nearly 60% of companies in the sector grew revenues by more than 20%. The 2021 tally was $100 billion above the next highest year on record in 2018 when the industry saw revenues of $484 billion.

The 2021 year-over-year growth was significant because 2020 was not a recovery year, but an above average year with 10.4% growth, said Cliff Leimbach, senior research analyst at Omdia.

While Intel held onto the top spot, it was based on flat growth of just 0.4% compared to 2020. Intel’s 2021 tally at $76.6 billion made up 13% of all chip revenue for the year, but the next top nine chip firms saw year over year revenue growth above 15%. Samsung and SK Hynix saw increases of more than 30% while Qualcomm, Nvidia, MediaTek and AMD saw increases of more than 50%.

Omdia said Samsung saw a dramatic increase due to the big jump in the DRAM market, up by 42%, and NAND market, up by 23%, putting Samsung on top in both components.

RELATED: Chip shortage: Engineers believe worst in yet to come