Only Apple bounced into positive territory in second quarter PC shipments, while other major brands saw stiff declines as the overall PC category entered its sixth consecutive quarter of contraction, IDC reported.

IDC analysts blamed the market-wide year-to-year decline of 13.4% on weak demand from consumers and commercial sectors and continuing macroeconomic headwinds.

What was special about Apple? Apple was slammed a year earlier in 2Q22 with Covid-related shutdowns in its supply chain, including with plant closings in China and other parts of Asia. As a result, its 2Q23 numbers were 10% higher. Apple shipped 5.3 million Macs in the latest quarter, compared to 4.8 million a year earlier.

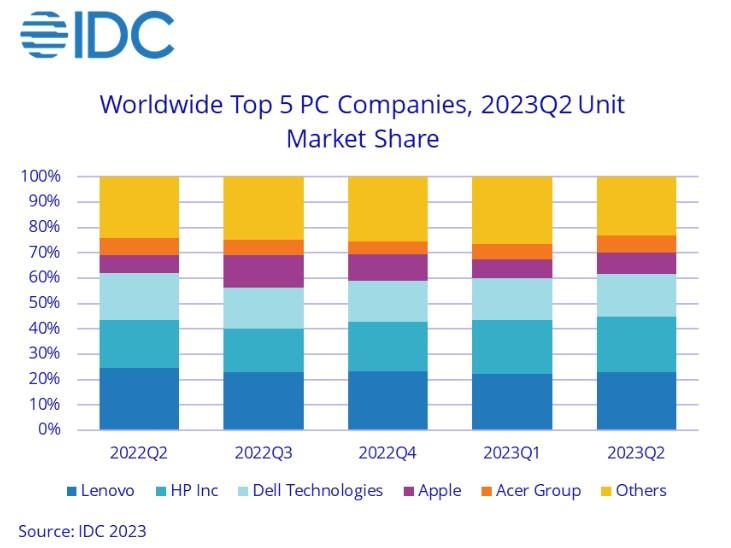

Apple’s showing kept it in fourth place with 8.6% of the market. The bigger worry was around Dell’s decline of 22% and first-place Lenovo’s decline of 18.4% year-to-year for the quarter, with 23% market share and 14.2 million PCs shipped.

Second place HP nearly went into the plus category, with a 0.8% decline year-on-year, with 10.3 million PCs shipped. (IDC counts desktops, laptops and workstations in the PC category, but not tablets or x86 services. )

HP has faced an oversupply of inventory and is just now approaching normal levels of inventory, IDC said

An inventory glut of components and finished PCs in the channel are dragging the market down, said Jitesh Ubrani, IDC research manager, in a statement. High inventory problems are slowly easing, he said, and many component suppliers are offering reduced prices. “PC makers and channels are still cautious about new systems due to the reduced demand,” he added.

“The roller coaster of supply and demand the PC industry has faced over the past five years has been extremely challenging,” said Ryan Reith, group vice president at IDC. PC makers “don't want to be caught with short supply like they were in 2020 and 2021, but at the same time, many seem hesitant to make the big bet on a market rebound.

“On the consumer side, we're seeing a return to pre-pandemic habits where computing needs are shared across multiple devices, and we firmly believe the consumer wallet will favor smartphones over the PC. On the commercial side, workforce reductions for many big companies as well as the introduction of generative AI only add more confusion as to where to place an already reduced budget."