Wireless transmission of data in industrial applications has been around for a long time but recently it has gained importance, with attention from both market leaders and medium- and small-sized competitors. Successful use of wireless sensors in systems such as supervisory control and data acquisition (SCADA) proved that these devices could effectively address the needs of industrial applications. The attempt in most critical process applications is to wirelessly communicate and monitor temperature, flow, level, and pressure parameters.

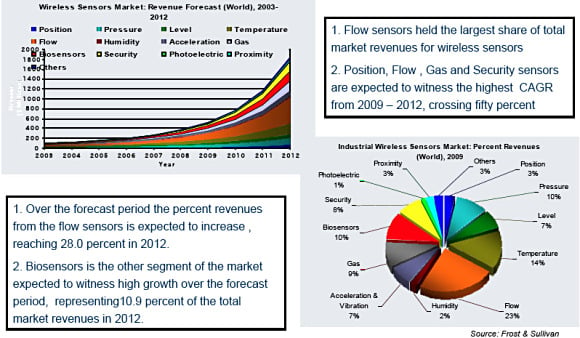

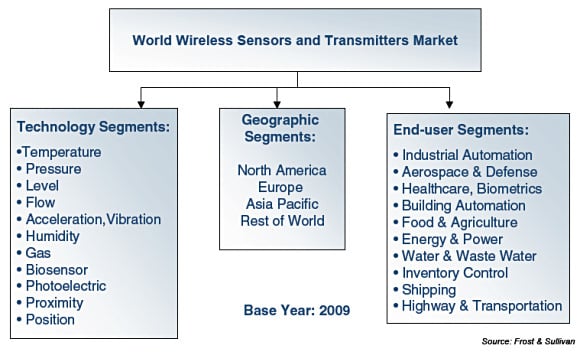

Although wireless sensing products for industrial applications now exist, the market is fragmented (Figure 1), consisting of a number of participants and a variety of applications. The adoption process has also been slow, as many challenges still need to be overcome despite the benefits offered.

Figure 1. Scope and key areas of research for the wireless sensors market in 2009 |

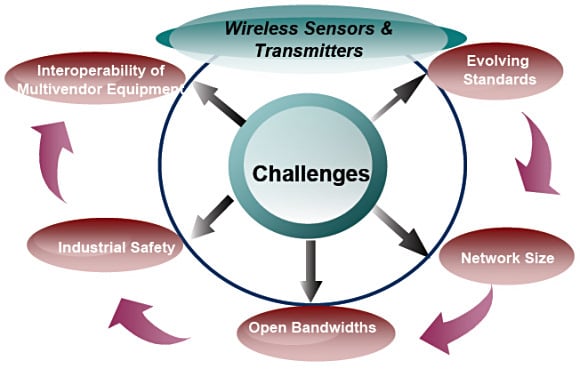

Key Challenges

Industrial applications offer a broad scope for growth in wireless sensor use, but this growth cannot be achieved without overcoming some of the key challenges facing the market, as shown in Figure 2:

- Multivendor equipment interoperability

- Demand for industrial-safety-rated wireless devices

- Lack of adequate open bandwidth

- Deployable network size and hopping challenge

- Constantly evolving standards

Figure 2. Key challenges for the wireless sensor market |

Interoperability is a major challenge for market participants. This is further exacerbated by the embedding of proprietary communication protocols and support software. Wireless communication technology is successful only if the equipment of different vendors can communicate. This multivendor interoperability environment is expected to be a long-term challenge—from a design standpoint—for both sensor and test vendors. In the future, we expect widespread use of different functions packaged together in a single control box and large-scale development of interoperable devices for industrial systems. Also, equipment must have plug-and-play options for ease of use as well as to improve market acceptance.

In terms of the development of industrial-safety-rated devices, vendors' ability to make a wireless sensor system fail-safe depends heavily on the type of application in which the wireless sensor is used. As such, understanding the application helps vendors to provide appropriate fail-safe measures that can be embedded into wireless systems.

Licensed bandwidths are a subject of disagreement in the market. Market leaders and large companies feel that the use of unlicensed bands interferes with the licensed ones and therefore should be completely eliminated. Tier-two and tier-three market participants feel that even though there are benefits to wireless sensor networks operating in licensed frequency bands, certain challenges remain to be solved. Presently most wireless sensor network devices operate in unlicensed bands such as 915 MHz and 2.4 GHz, and reliable communication can be affected by interference from other devices operating in the same frequency band. However, the majority of the market participants feel that the use of unlicensed bands is likely to bring in larger benefits accompanied by unrestricted growth as well as to provide equal opportunity to market participants operating on the same platform. There are various initiatives taken up by companies to promote open bandwidths.

Key Hardware Issues

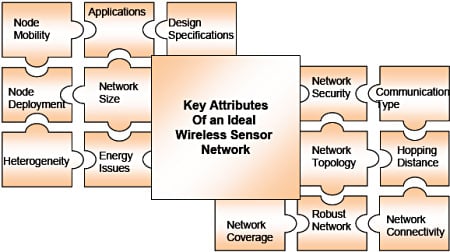

There is no ideal wireless sensor or transmitter that could be used for all conceivable applications. In fact, each application determines what attributes the wireless transmitters should have.

Wireless sensors, transmitters, and networks are used for diverse applications with varying requirements and characteristics (Figure 3). Designers and the research community are developing a hardware design platform capable of supporting multiple applications. It is imperative for market participants to have a set of hardware platforms with different capabilities that cover the design space and cater to most market opportunities. A modular approach under which individual components of a sensor node can be easily exchanged is a solution for multiple applications.

Figure 3. Hardware attributes most sought after by end users (2010) |

Key Network Issues

Because wireless sensor networking is built around low-power radios, the nodes that make up the network play a key role in wireless communication (Figure 4). From a physical perspective, the deployment of nodes may take several forms depending on the sensor application and the desired pattern of communication. Deployment may also be a one-time activity, where the installation and use of a sensor network are strictly separate activities. It can also be a continuous process where more nodes are deployed over the lifetime of the network.

Figure 4. Key attributes of an ideal wireless sensor network |

The location of the wireless sensor nodes can also undergo changes over the life of the sensor system. This change of location can be either intentional as required by the system design or desired by the users or be due to external changes such as environmental changes. Mobility can be active or passive. Active mobility can be like an automotive application in which the mobile node must dynamically adjust its direction in accordance with the signal strengths between sensor nodes until it arrives at its desired location. Passive mobility involves a node attached to a moving object where the object is not under the control of the sensor node.

The application needs determine the actual size of the network. The application can vary from a single sensor node to multiple sensor nodes. Again, the size of each sensor node can vary from a large box to a microscopically small particle. Most of these tiny nodes developed by labs have yet to be deployed in any application. However, these microscopically small particle-sized sensor nodes have the potential to be used in a number of military applications.

Revenue Trends by Type of Sensor

To date, wireless does not predominate in the sensors and transmitters market. Temperature, pressure, level, and flow are the most measured parameters and sensors for these properties are common in the processing world. In addition, other wireless sensors such as those for position, proximity, image, and security find large-scale use in industrial applications. However, the big four wireless sensors for measuring temperature, pressure, level, and flow generated the largest portion of the overall market revenues in 2009, with revenue shares of 14.3%, 9.9%, 6.6% and 23.6%, respectively.

Level sensing accounted for 6.8% of the wireless sensors and transmitters market in 2009. It is used to monitor material levels and to track the rate of material usage in remote locations, enabling timely replenishment. Wireless level sensing is used mostly in industrial applications such as tank inventory monitoring and logistics, equipment preventive maintenance, and real-time truck scheduling and routing. The cost of remote tank inventory monitoring is lowered/can be lowered significantly by using a wireless level monitoring system.

In 2009, the revenue achieved in the wireless pressure sensors and transmitters market was $51.9 million. The deployment of wireless pressure sensors and transmitters is expected to increase due to emerging applications in industrial process control, environmental monitoring, and biomedical systems, which now require sensors to function wirelessly.

Flow sensing is another area where cost factors and the risks involved in wiring have led to the development of wireless flow sensing. Wireless flow sensors generated revenues of $124.5 million in 2009. The low demand and perceived limitations of wireless communication have led to a lower rate of adoption than expected. Most of the end users of high-end applications are increasingly opting for wireless sensors because of the ease of operation. This makes the flow sensors expensive, but offers several advantages, namely the ability to monitor inaccessible equipment, such as oil pipeline or critical operations in power plants; high-speed communication, enabling rapid access to results; and the ability to ensure the security of the equipment.

Long-term remote wireless monitoring of flow data is possible with minimal site visits. Thus, the combination of wireless communications and remote monitoring capabilities enables applications in sanitary sewer flow, infiltration inflow, billing monitoring, sewer capacity, storm sewer monitoring, wastewater treatment influent/effluent monitoring, disinfection/contact basins, and stream and river flow.

In 2009, the size of the wireless temperature sensors market was $75.3 million. Wireless temperature measurement is growing in importance in areas such as office buildings, retail locations, school and university buildings, museums, historical buildings, atriums, cleanrooms, environmental chambers, laboratories, archival storage, restaurants, supermarkets, convenience stores, and food warehouses. Because the wireless sensors can be readily adapted to changing floor plans, they are well suited for use in office buildings, retail locations, schools, and universities. Wireless temperature sensors are gaining importance in these areas as they provide control of equipment and maintain occupant comfort.

Wireless sensing of acceleration, vibration, and velocity is important as well, as these devices have made online monitoring more effective in preventing equipment failures. These sensors had 7.1% of the total market in 2009. Wireless gas sensors that accounted for 9.0% of the total market revenues in 2009 are used mainly for the monitoring of different gases in hazardous environments.

Wireless pressure sensors are expected to have a significant role in most manufacturing processes that witness significant pressure during the production cycle. Wireless sensors offer flexibility of installation, resulting in improved process monitoring and control and also reducing installation and maintenance costs. The most recent development effort is focused on integrating an ultraminiature and low-power wireless radio with a pressure sensor. This wireless package would enable the automatic control of fluidic valves and HVAC systems. Similarly, wireless modules that have pressure, flow, and temperature monitoring and control options are being developed with the aim to reduce installation and cable costs by deploying wireless sensors in large commercial and industrial buildings.

The total revenues for wireless sensors and transmitters in industrial applications in 2009 reached $526.7 million. This market revenue is likely to reach $1.8 billion in the next four years. The size of the wireless pressure sensors and transmitters market alone is expected to reach $132.9 million in 2012 (Figure 5).

Wireless acceleration, vibration, and velocity sensors and transmitters generated revenues of $37.5 million in 2009. Smart wireless vibration sensor technology is required in critical manufacturing processes to enable condition-based maintenance (CBM). The health of the components of mechanical systems, including power plants and powertrains on DOD weapons, can be monitored using wireless vibration sensors. Other applications in which these wireless sensors are used include distributed monitoring and control and applications in which point-to-point wiring is unattractive. Reliance on wireless sensors is increasing, as their use enhances the identification of problems prior to actual system failure. By 2012, the size of this market is expected to reach $112.5 million.

Currently, the installation of wireless position sensors is limited. Position and proximity sensors are, at times, used for either presence or absence detection or for positioning. The revenues of the wireless position sensors and transmitters market in 2009 amounted to $17.5 million in 2009 and is expected to reach $69.4 million in 2012, which is a very steep increase considering the size of this market.

A host of other sensors with wireless capability exist—including Hall effect, optical, and image—but applications are predominantly niche applications and sales are low. Together, this class of wireless sensors generated a revenue of $14.1 million in 2009.

Conclusion

There is a long list of major competitors both in the wireless sensor and network space. Some of these companies are major semiconductor manufacturers such as Atmel Corp., Chipcon AS, and Freescale Semiconductor Inc. Most of the companies mentioned in this article are promoters and members of the ZigBee Alliance. Many companies such as Crossbow Technology Inc., Dust Networks Inc., and Ember Corp. have been responsible for the growth of wireless sensor networking to its current technological level. Several companies such as RAE Systems have been in the gas-sensing market for a long time and are now venturing into the wireless sensor network arena. Most well-known automation companies such as Honeywell International Inc. and Emerson Electric Co. (Rosemount Div.) have been successful in developing wireless monitoring and control products focused on industrial applications.

Wireless sensors can be deployed almost anywhere at a far lower cost than can a wired system. With the recent advances in embedded systems and wireless technology, the hardware used is becoming more inexpensive and more widely available. Also, since these devices comply with industry standards such as the IEEE 802.15.4 for radio communication hardware and the emerging ZigBee and WirelessHART standards for networking among devices, end-user adoption is increasing.

The security of wireless networks remains a key concern. Certain proprietary protocols have been developed to prevent breaking into the network. However, multiple wireless networks operating simultaneously in a plant setting remains a concern due to increased signal interference. Such interference could be normal or could be caused by outside sources attempting to compromise the network's security. The existence of these island networks is a great operational challenge whose impact is bound to grow as wireless sensor network adoption increases. Despite the challenges mentioned earlier, wireless sensors are the future of communication and control networks in industrial settings. Their adoption in manufacturing plants, process control, power generation plants, test and measurement instrumentation, infrastructure, and medical devices is likely to experience exponential growth.

ABOUT THE AUTHOR

Dr. Rajender Thusu, PhD, is Team Leader covering sensors for Frost & Sullivan's Measurement & Instrumentation practice in North America. He can be reached at 210-247-2498, [email protected].