Image sensors are currently experiencing particularly impressive growth potential in the automotive sector, specifically in Advanced Driver Assistance Systems (ADAS). In these ADAS, image sensors improve driver safety by helping the car gather information about the outside world. ADAS embraces a number of technologies such as sensors, radio detection and ranging (radar), light detection and ranging (LIDAR), and integrated cameras to provide drivers with an all-round picture of their surroundings.

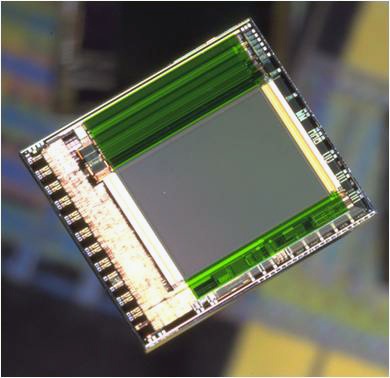

Automotive image sensors are experiencing significant growth due to the rise of ADAS systems.

One example of an ADAS currently on the market is Lane Departure Warning (LDW), a mechanism that alerts drivers if and when their vehicle begins to move out of its lane. By addressing a major cause of collisions, these systems help to prevent accidents that may be caused by driver drowsiness or carelessness. There are two types of such system: one which warns the driver with a visible or audible signal when the car changes lanes, and another system, called Lane Keeping Systems (LKS), that automatically reacts to ensure the vehicle remains in lane.

Circuit boards allow image sensors to capture information about a vehicle's surroundings.

These systems are based on video sensors in the visual domain, typically placed near the rear mirror. They also utilize laser sensors and infrared sensors. Other examples of ADAS include adaptive cruise control (ACC) and automatic parking. Also, there are developments in completely self-driving vehicles, also known as autonomous cars. These systems are capable of sensing their own environments and operating without human effort and there are some big names involved in these developments, including internet giant Google. The Google Self-driving Car is an extension of ADAS, designed to make driving both safer and more efficient.

The market for ADAS systems is growing significantly. Analysis of the market reveals possible growth at a rate of over 50% Compound Annual Growth Rate (CAGR) until 2018. Market value may also rise from the current value of around $18.5 billion, to $165 billion in the next five years.

ADAS with vision-based inputs such as cameras offer particularly promising and unique opportunities to the image sensors industry. Camera-based ADAS is not new; this technology has had time to mature over previous years, but was mostly seen as a customer option on premium brand cars. Historically, ADAS have only appeared in luxury high-end vehicles, however there has since been a significant shift. For example, it was once an expensive option in the Lexus LS400, costing about $3,000.00 extra. Now it is a $395 option on some mainstream Ford vehicles.

Different types of sensors are being deployed in various systems today. For the environmental near and far-field monitoring around the vehicle, radar, LIDAR, ultrasonic, PMD, camera and night vision sensors are used. The most advanced works combine the sensor data (data fusion) to achieve accurate results. Camera systems will see an additional boost in the near future, looking inside the car in order to analyze the driver's state. In coming years, driver situation and prediction analysis will be used to better filter the various warning messages an ADAS is capable of generating.

There are both consumer and regulatory drivers for this increased use of ADAS. While consumers tend to enjoy new gadgets and would like to decrease their risk of accidents, regulators have ambitious targets for improving road safety for both drivers and pedestrians. In 2010, Euro NCAP, the safety certification body, launched a reward program called "Euro NCAP Advanced" to promote adoption of advanced safety techniques. Recently, Euro NCAP announced only cars with ADAS systems would be awarded their top five-star safety rating.

In the US, the key safety goal of the US Federal Motor Carrier Safety Administration (FMCSA) is to reduce the number and severity of commercial motor vehicle (CMV) crashes. In recent years, the FMCSA has been in collaboration with the truck industry to test, evaluate, and facilitate the use of on-board safety systems for CMVs in order to improve the safety of all road users. In addition, the National Highway Traffic Safety Administration (NHTSA) Safecar initiative will drive regulatory adoption of ADAS in domestic vehicles.

These developments have marked a step change in the need for ADAS systems in volume production vehicles. This has inevitably led to an increased employment of ADAS, representing a huge commercial opportunity for image sensor companies. First and foremost, Euro NCAP's tightened safety requirements will boost installed ADAS equipment from single-digit to almost 100% over coming years, so it's no surprise that the call for a commercially viable solution is on.

With the major auto-vendors realizing the huge potential in this market, many of them such as GM, Ford Motors, Toyota, and Audi, etc., are making significant investments to improve their understanding and implementation of ADAS systems in vehicles during production. In addition, a number of independent technology enterprises have entered the market to provide ADAS solutions to on-road vehicles, driving up the aftermarket sales of this type of technology, which is also a booming market. Some of the major enterprises which are providing ADAS include Valeo, Continental, Aisin Group, Audiovox Corp, Ficosa International S.A., Hella KGaA, and Hueck & Co.

Geographical analysis of the ADAS market shows that while the US and western Europe are still the major markets, a number of Asian passenger car producers such as Nissan, Toyota, Honda, and Hyundai/Kia are also beginning to offer ADAS. In the near future, countries such as China, South Korea, and Japan are expected to make driver assistance systems mandatory, therefore the market is anticipated to grow with a promising growth rate in the next five years.

If you need to know more about the use of image sensors in automotive applications, take a look at the annual Image Sensors (IS) conferences. For example, the IS Auto event taking place June 17 through 18 in Brussels will provide an in-depth analysis of imaging in the automotive sector, offering perspectives from OEMs about the drivers for adoption of imaging systems in mainstream automotive applications as well as future trends for automotive imaging.

About the Author

Robert Stead graduated with a BSc (Hons) Environmental Science from the University of Nottingham in 2005, and he started as a Conference Producer with Smithers the same year. He has remained with the company for eight years and now holds the position of Head of Events EU, where his team of nine delivers over 20 high profile technical conferences a year across Europe and Asia, covering a broad range of industries.

Robert is a familiar face to many in the image sensors community. As the Programme Director of the Image Sensors conference, and with the help of the Programme Committee, Robert has overseen the event growing from a 70-person technical event to 200+ attendees and a 15 stand exhibition.