Welcome to the second episode in this eight-part tutorial series. In Episode 1, which appeared in Sensors Online in September, I provided an introduction to the overall role of marketing to support the successful commercialization of sensors/MEMS in addition to drilling deep into the critical concept of listening to the voice of the customer (VOC). This episode will address the topic of marketing’s role in the funding process of sensors/MEMS organizations.

For those who did not read episode 1, I offer here a brief note of explanation. The information to be provided throughout the tutorial series was created from in-depth interviews of over 15 marketing and executive professionals whose cumulative experience in the sensors/MEMS field exceeds 350 years. Their contributions emanate from their real life personal experiences and are not textbook sourced.

The funding of a sensors/MEMS organization begins as part of the organization’s founding process. Marketing research needs to be widely used to be able to create a defensible business plan which is the Holy Grail to this process. The results of thereof must be submitted and accepted by the funding agents, whether they be angels, venture capitalists (VCs), or corporate strategic partners. Judicious market research needs to be conducted to determine:

- Target audience(s)

- Market size and growth rate

- Competitive strengths and weaknesses

- Internal competencies

- Unmet customer needs (obtained vis-à-vis listening to the VOC)

- Appropriate positioning and branding strategies

- Optimum chains of distribution

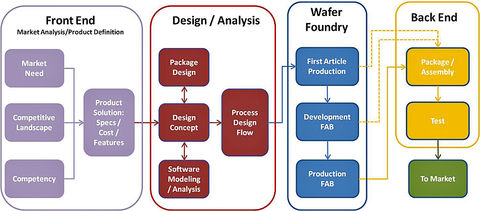

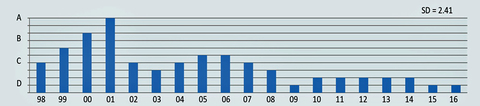

The MEMS Commercialization Process, provided as figure 1, illustrated these activities. I have addressed the topic of VC funding as part of the 14 critical success factors for MEMS commercialization in my annual Report Card which I initiated in 1998. Figure 2 shows the grades for VC funding attraction.

The 2016 grade was D and was similar to its 2015 grade. And as can be seen, VC funding attraction continued to receive lackluster grades and has done for many years being in the D range since 2009. Its highpoint was in 2001 where the whole high tech industry was the recipient of huge amounts of VC fundus during the optical telecom “bubble”. I believe that this lackluster grade trend will continue for the foreseeable future.

The reason for the recent dismal grades is that VCs have been for some time enamored by and large with funding software companies versus sensors/MEMS hardware companies. Hardware companies typically require a more substantial investment in materials and equipment as well as in the use of outside and expensive silicon wafer fabrication and packaging foundry services. For an entrepreneurs to get through this flack they need to have bulletproof business plans incorporating their strategy of capturing large and growing markets with unique products that can produce significant profit margins. Providing strong and defensible marketing content to the business plan will significantly help increase the chances of funding.

While funding from angel investors and VCs still exists, and primarily for non-hardware prospects, sensor/MEMS hardware companies need to be on top of their game to be able to successfully attract funds. A Silicon Valley MEMS hardware startup, Chirp (MEMS oscillators) has recently been successful in attracting funding as well as Boston-based Vesper (MEMS microphones). Recent European startup founding of hardware companies include USound in Austria (MEMS speakers) and Leman Micro Devices in Switzerland (sensor systems for medical diagnostic applications). Several interviewees' comments on the subject follow.

Swami Rajaraman (UCF) said, “As part of my co-founding team of Axion Biosystems, we engaged a biotech marketing firm to help us develop our proposal and help win a National Institute of Health (NIH) Phase 2 Small Business Innovative Research (SBIR) grant. We conducted many interviews to better understand the voice of the customer (VOC) which helped us gain valuable insights into the unfulfilled needs of the market. We also used this information as part of our new business plan to attract angel and VC funding. Most startups do not have a marketing person as part of their founding team we correctly decided to break the rules and bring aboard a marketing person as a CEO to join the five- person founding team, two of which were professors at Georgia Tech. This was a very smart move for us and we were quite successful in raising money and developing meaningful products.”

Kurt Petersen (Silicon Valley Band of Angels) said, “it is very difficult at this time to obtain funding for hardware companies, and as such, we i.e. the SV Band of Angels, have become extremely discriminating with all hardware companies including sensor/MEMS companies needing funding. In the business plans of our colleagues seeking funding, we see a significant lack of marketing tools proposed to be deployed. Chief amongst these are branding, positioning, promotion and chains of distribution to reach the market. We are always looking for companies who can clearly demonstrate their ability to anticipate market needs. In today’s market, it is necessary to obtain multiple rounds of angel funding before one goes to the VCs for a Series A. Additionally, we consider the winning of government awards to be a good omen for the future success of the organization. Most especially, the winning of a Phase 2 SBIR award since this is highly competitive and focuses on the proposed commercialization plans of the organization. We consider it to be a credential comparable to graduating from a top- notch engineering school with a Ph.D. and an exceptional thesis topic.”

Tom Nguyen, a serial sensor/MEMS entrepreneur and the CEO of DunAn Sensing (San Jose, CA) says, “From my experience, as a serial entrepreneur, I used to think that entrepreneurship equated that anyone that has a good idea can get funded. But the reality is very different. When I started up DunAn Sensing, my MEMS & sensors devices and packaging company, and was seeking funding, I talked to at least a dozen VC firms and I had no luck. I have learnt over the years that VCs fund products that solve problems that they understand, and without that, it is very difficult to be successful. Also, without a PhD from a major research university like Stanford, MIT, Harvard or Berkeley on the founding team… in addition to preferably being located in the San Francisco Bay Area, Boston or New York City, I believe one is at a major disadvantage to be funded. Instead, I continued to talk with the VCs and hoped that I would find one to fund my ideas. It was frustrating to be in a position of having no control of the process or not knowing when and if I would get funded. As a result, I had to create a new and better plan for the funding strategy.”

“My plan was based on getting the product and technology fully qualified and conduct market research to uncover and subsequently engage with a key customer in the top five to ten players in this market and conducting rigorous market research and identify potential strategic investment partners who require this kind of product and technology to better differentiate and add value to their product. More importantly, this time I decided to pick the partner that offered the best fit for my business having critically assessed my internal core competencies instead of having them pick me.”

“From the above plan and strategy, I worked diligently to ensure that my product could pass the rigorous qualification testing scenario. Also, I conducted additional market research to select and engage with a key customer willing to qualify my product. After two months of testing, my product passed customer’s requirement. This was a key achievement of the first step. After having a customer fully qualified our product. I went back to conducting additional market research to identify several potential strategic investment partners for this product. Surprisingly, I have been able to have two potential investment partners that would like to invest into my company’s technology”

“The problem was that I had to decide and choose who will be the right partner for my company and product? After a significant amount of conducting additional due diligence on each of my suitors, I finally decided to go with the one who would not only financially invest in my company but also be able to help me to develop the customers and market for this product. The rest is history and DunAn Sensing is on a strong path of success…all the work that we invested in due diligence and market research paid off and we are quite gratified with the hugely successful outcome in picking the best partner.”

Summary

This is the second episode of an eight-part tutorial series on the topic “Sensors/MEMS Marketing: Oxymoron or Opportunity.” The first episode provided an introduction to the series and a deep dive into “listening to the voice of the customer (VOC). I trust that this episode delivered a very accurate view of Marketing’s Role in the Funding Process, vis-à-vis the opinions provided from in-depth interviews and subsequent verbatim statements from several of the industry’s most experienced, notable, and prestigious individuals in addition to those of my own.

The 15 interviewees for the series had an average of approximately 23 years of experience in the marketing/sales/business development area which constitutes approximately 350 years of combined experience, much of this in the sensors/MEMS area. It is my sincere desire that the materials provided in this episode and in the entire series will amuse, inform, and excite its reader and provide them with a new perspective on the value of adopting marketing into their portfolio of tools necessary to create a successful organization. Episode 3 will address the topic “Putting the “S” Back in MEMS.”

Acknowledgements

The author would like to acknowledge the contributions of the following individuals who were interviewed for these articles and who provided valuable and information. Thank you all so very much.

- Sandeep Akkaraju, President /eXo Imaging (Formerly: CMO Jyve)

- Robert Andosca, Ph.D. CEO Inviza (Formerly: CEO microGen)

- Matt Apanius, General Manager, Smart Microsystems

- Janusz Bryzek, Ph.D., CEO/eXo Imaging (Formerly: CEO Jyve)

- Juan Figueroa, Ph.D. CEO/Abenaki Connect (Formerly: SBIR Program Manager/National Science Foundation)

- Brian Kinkade, Founder, Positive Impact (Formerly: Marketing and Sales VP, Spec Sensors)

- Mark Laich, CEO/Laich Advisory Group, (Formerly: VP Sales and Marketing/ MEMSIC and V.P. Business Development /Qualtre)

- Keith Myers, V.P. Marketing/ TEConnectivity

- Steve Ohr, Semiconductor Industry Analyst and Reporter (Formerly: Semiconductor and Sensors Analyst/Gartner)

- Kurt Petersen, Ph.D., Member/Silicon Valley Band of Angels (Formerly: CEO/SiTime)

- Paul Pickering, V.P. Business Development /Micralyne

- Swaminathan (Swami) Rajaraman…, Ph.D., Assistant Professor/University of Central Florida

- Paul Werbaneth, Director of Marketing/Intervac

- Steve Whalley, Whalley Consulting (Formerly: MEMS and Sensors Industry Group/Chief Strategy Officer)

About the author

Roger H. Grace is president of Roger Grace Associates (RGA), a Naples Florida-based marketing consulting firm specializing in high technology, which he founded in 1982. His background includes over 40 years in analog circuit design engineering, manufacturing engineering, application engineering, project management, product marketing, and technology consulting. He can be reached at 239-596-8738, [email protected].