This is the third episode in my eight-part, bi-weekly tutorial on the subject…”MEMS/Sensors Marketing: Oxymoron or Opportunity”. For this episode, I have decided to bring out some heavy guns, those pioneers in the MEMS industry including several highly qualified professionals in my interviewing process who have had the experience of participating in the MEMS industry for several decades and in its early days. These include Joe Giachino, formerly Program Manager, a.k.a. Mr. Sensor at Ford Motor Company who has had his first run-in with MEMS in 1968 as a design engineer and currently an Academic Affiliate at the University of Michigan; Dr. Jim Knutti serial MEMS entrepreneur and CEO of Acuity who started off in the late 60’s as a Ph.D. student at Stanford working on MEMS under Prof. Jim Angell and Ally Hartzell, a managing engineer at Vryst Engineering LLC …the individual who literally wrote the book on MEMS reliability [1]. Together, their cumulative years of experience far exceed 100. This is to add to the existing base of contributors to these eight episodes whose cumulative experiences exceed 350 years.

I believe that MEMS have gone through many exciting “waves” of innovation and application success since their discovery and through their full commercialization. MEMS (or whatever it was called at that time) were discovered in 1954 by Charles Smith at Bell Labs vis-à-vis his seminal work on the piezoresistive effect in Silicon and Germanium which appeared in Physical Review [2]; much the same time that semiconductors were discovered.

The early work on both technologies was conducted at Bell Labs in New Jersey. In my opinion, the launch of MEMS was highly facilitated by Kurt Petersen (one of our contributors in the last episode) in his seminal work, “Silicon as a Mechanical Material”, where he provided a broad range of sensor types that he had developed while a researcher at the IBM Almaden (San Jose, California) Labs [3]. This article has been referenced over 1613 times in articles and 314 times in patents.

Kurt truly was a visionary. It is interesting to note that I had the honor and pleasure to provide marketing consulting services for approximately 10 years to Kurt, Janusz Bryzek, and Joe Mallon who were the founders of the MEMS startup NovaSensor approximately 30 years ago. Here, my job was to position and brand the MEMS technology, then called micro machined sensors, to the marketplace. This tended to be a technology push versus applications pull approach.

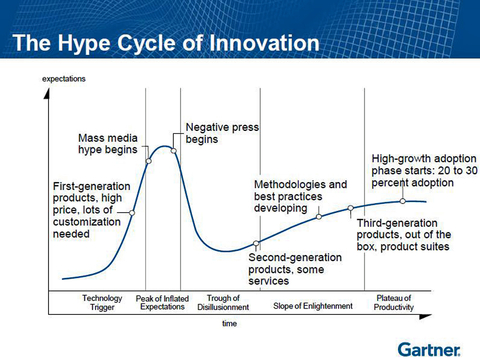

We decided to take this approach to brand and position NovaSensor as the spokesperson of this technology and it was very successful. MEMS was in full shine during that period of time and could be said that it was riding on the Gartner Hype Curve in the “peak of inflated expectations” region.

Since those times, the semiconductor market has grown to $338.5 Billion (US) in 2016 as reported by Gartner (to be described later). On the flip side, the MEMS market has grown to approximately $16 Billion as reported by several organizations.

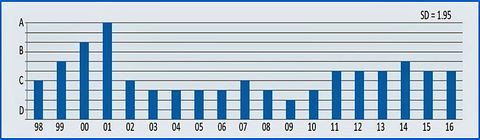

I created the “MEMS Commercialization Report Card” [4] to address the 14 critical success factors in an effort to better understand the rationale of this major disparity and what were the root-causes for the more than 20 times difference between their market values. The topic of “Venture Capital Attraction” was addressed in the previous episode while figure 1 shows the grades over the same period for “Creation of Wealth”.

I believe that the topic of “Creation of Wealth” has a significant positive correlation with the level of the MEMS “shine”. Simply said…people get rich when the technology that they are promoting is in favor with the market. It is widely known that in the venture capital community, the funding of MEMS/sensors “hardware” companies has not been in favor for quite some time as discussed in Episode 2.

Certainly, several excellent MEMS/sensor startups have received VC funding over the past several years. However the lackluster performance of several MEMS startups including Qualtre, Sand 9, Lilliputian and Infotonics have lost their investors considerable amounts of money and as such have, what I consider poisoned the well for future entrepreneurs and their attempts to receive funding.

Recent successes (liberally defined by me as where the money out was greater than the money in) was realized by several startups including Pixtronics, Jyve and most notably by the learning thermostat company NEST, which I received $3.2 Billion from Google in 2014. Interesting note, NEST is not a sensor company but rather a systems solution company which created an intelligent thermostat by integrating approximately seven sensors into the product that won the favor of Google. It is frequently necessary to have hardware prototypes with measured results available to entice VC investors. There is hope that recent startups including Chirp Microsystems, MC-10, Vesper and U-Sound will be success and thus raise the enthusiasm of investors and, as such, benefit future entrepreneurs.

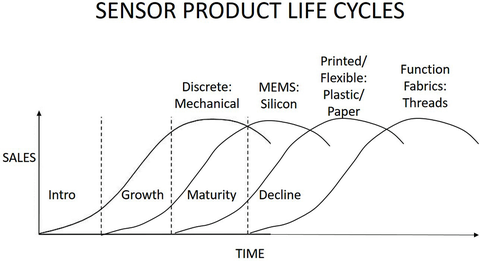

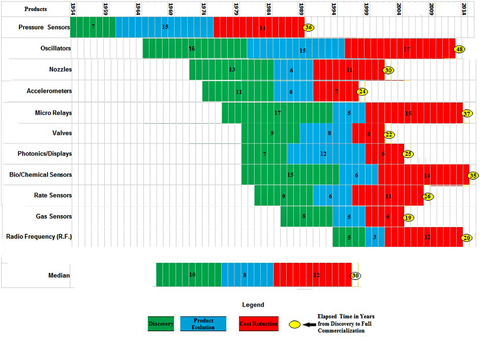

I prefer to consider MEMS application opportunities as historical “waves”/ significant growth cycles. This occurred first in the military sector (mid-late 1960’s), then automotive (1980’s), then optical telecom (late 1990’s), and next came mobile phones (mid-2000’s). Over these years, many MEMS sensors were created and went through as long process of achieving commercialization (figure 2).

These were supported by various sensor platforms: first discrete mechanical, followed by Silicon MEMS. Waiting on board, we are now seeing printed/flexible sensors using platforms including paper and plastic to be followed by functional fabrics based on threads (figure 3).

From an applications perspective, we are waiting (and waiting patiently) for wearables and IoT applications to carry on the legacy. I believe that in the early days, the term “MEMS” has a brilliant shine associated with it. Now, I believe that the shine is more like a patina or luster, as in a natural consequence for fine furniture, leather, wine (and perhaps some people). I believe that users of MEMS are now “over” their “love affair” and have “grown up” and are being realistic to look at MEMS as functional elements in a system as we will discuss in the future episode on “putting the S back into MEMS”.

From another perspective, I believe that, like most technologies, MEMS has gone through the popular Gartner Hype Cycle. It has been over 50 years since MEMS’s discovery by Charles Smith at Bell Labs and it has dutifully progressed through the Gartner Hype Cycle of five phases: from technology trigger to peak of inflated expectations to trough of disillusionment to slope of enlightenment and to finally plateau of productivity (figure 4).

It is widely accepted that many MEMS devices have been marginalized and become pure commodities. That’s why we need to put the “s” back in MEMS to achieve product differentiation, enhanced functionality and resulting profit margin, which will be discussed in-depth in a future episode.

Finally, with the focus of enlightened engineers looking for sensor solutions [5] to create their products, functionality (and not format) is critical. With the recent appearance of printed/flexible/stretchable and now with functional fabric sensors, the product designer has additional “tools” in his/her toolkit to create their product. These new sensors offer unique functionalities including stretchability and shape conformity and have the ability to be manufactured at very low cost [6]. They are expected to play a major role in the success of the Janusz Bryzek “Trillion Sensors Initiative” [7].

Joe Giachino said, “MEMS is a technology that has enabled cost effective transduction devices for small, low cost, high volume products. These products normally consist of the transduction device, electronics and package. Many products still use the MEMS prefix to indicate that they are lower cost and smaller size (accelerometers, gyros) and many omit the prefix (pressure). System integrators continue to be interested in what the product can do. MEMS is an established technology that is past the “gee whiz” stage. MEMS devices will continue to be used in many products (consumer, automotive, industrial, and military) but the emphasis will be even more on the end product capability. Low cost, low power, size, reliability, etc. will be what is marketed not MEMS. MEMS is established with nano and additive technology being the new technology.

Jim Knutti, CEO of Acuity said, “Rather than the shine being off MEMS, the situation is one of the hype subsiding. This is a much healthier situation for the industry that is based on commercializing MEMS technology. For many years, the technology has endured a herd mentality, where the focus lurched from one hot topic to the next. At the same time, very healthy and profitable segments enjoyed sustained and controlled growth. MEMS technology will continue to be an enabling link between the physical mechanical world and intelligence, both for gathering information and providing a response. Future systems will enjoy the current MEMS infrastructure base. Areas for growth will include autonomous systems that will also take full advantage of artificial intelligence. Currently underserved areas with a lot of potential include medical diagnostics and intervention, human prosthetics, and manufacturing.”

Ally Hartzell of Vryst said, “Are MEMS anything special anymore? Sensors is the keyword now, and MEMS are just a subset. But back in the day, I remember working at Analog Devices (in the late 90’s) when we moved inertial MEMS to mass production. Many in industry were concerned about the reliability of these tiny moving structures which were manufactured on a Silicon wafer. We made the MEMS reliable with high yield. We sold the device itself which was integrated into a system by our customers.”

Now, MEMS are not solely manufactured on silicon wafers—some MEMS are made on glass substrates while some sensors are printed on flex circuitry, for example. MEMS manufacturers are selling systems; systems can contain a few MEMS devices with an ASIC or microcontroller. These systems are integrated into larger systems, making reliability more important than ever.”

“Next generation technologies that will are here now and will continue to be promising in the future include smart homes and smart cities (for energy efficiency), wearable technologies (for fitness and health), medical devices (including microfluidics), robotics (using accelerometers, magnetometers, and gyros) and autonomous vehicles (drones, driverless cars). I don’t think MEMS are reducing in popularity or not shining anymore, it’s just that the consumer doesn’t know there are MEMS inside and doesn’t care. MEMS are now just another sensor, and we have to acknowledge that some amazing packaging developments are driving sensor technology as much as the new sensors themselves. Multiple sensors in systems require clever interconnect technology with advanced packages (see link below). There is still so much to do in the MEMS and sensors world; the future of MEMS is still shiny, but it’s not the MEMS themselves that are novel anymore.”

There were two optimistic interviewees. Paul Werbaneth (Intervac) said “I would like to provide two MEMS stories as to why MEMS remain to be very important and shiny: drones, one of today’s hottest products, couldn’t fly without MEMS-based navigation and stabilization, but you wouldn’t know it from the way drones are spoken of – MEMS are invisible … second MEMS story: the 2017 IMAPS Device Packaging Conference included some kind of MEMS content in almost every single talk over 2.5 days, even though DPC was not a MEMS conference – MEMS are ubiquitous.”

Steve Whalley (formerly MEMS and Sensors Industry Group) said, “Shine off of MEMS? Not where I am looking. It may be true in some mature markets where any basic inertial sensor module will do, but in new MEMS/sensor form factors and applications in health, agriculture, environmental, energy, VR, drones, robotics and more, it’s very much an exciting industry to be in. And as MEMS/sensors find their way into flexible, hybrid and printed solutions, the best is yet to come. And don’t forget, up until now we have essentially been talking about discrete MEMS/sensor solutions. We will be seeing more integrated and arrays of sensors being used in the next few years coupled with machine learning software – watch out and get your seatbelts on and shine on baby.”

Summary & Conclusions

There was a great deal of consensus with the interviewees that as MEMS have matured, from their “brassy” beginnings to today’s “patina” where their “shine” has given way to their usefulness in creating solutions to applications. Many enlightened engineers are selecting MEMS for what they bring to the party and not because of their technology.

MEMS continue to play a major role in satisfying the measurement of a wide range of physical, chemical and optical sensing applications. It is important for marketers not to hype the brand of MEMS (similar to what I did in my early consulting days at NovaSensor), but rather stress their unique qualities that make them the solution of choice.

When MEMS became commercialized, beginning with pressure sensors as shown previously in figure 2, they became valuable additions to the design engineers’ toolkit. This concept must continue to this day, it’s all about selecting the optimum solution for the application…and not being enamored by the technology for technology sake. From a markers perspective, they need to create and execute marketing programs with this in mind, dictating an applications pull rather than a technology push strategy and promoting the inherent advantages of the technology that they are selling.

I believe that the next major opportunities for MEMS/sensors will be in the IoT and autonomous vehicle applications. Here MEMS are beginning to play a valuable role and are expected to continue to do so in the future. Additionally, mobile phones will begin to crave new sensors, and mostly MEMS because of their size and cost. These include environment/bio sensing for environmental monitoring, water and food quality and physiological measurements as well as optical sensing for security. Marketers will have a great opportunity to sell the inherent advantages in MEMS to support these opportunities.

The next episode will appear on November 3 touching on the topic of insider hints on creating and executing successful marketing campaigns.

REFERENCES

[1] A. Hartzell, M. da Silva, H. Shea; MEMS Reliability; 2011 Edition; Springer Press; 201 pp.

[2] C. Smith; Piezoresistance Effect in Silicon and Germanium; Physical Review; Vol. 94, Issue 1; pp.42-49

[3[ K. Petersen, Silicon as a Mechanical Material, IEEE Proceedings, May 1982, pp.420-457

[4] R. Grace; MEMS Commercialization Report Card; Commercial Micromanufacturing International; Vol. 8,No. 5; pp.40-45; http://www.rgrace.com

[5] R. Grace, Think Outside the Chip: MEMS-Based Systems Solutions, Sensors Mag/Sensor Insights, April 30, 2010, http://www.rgrace.com

[6] R. Grace, Printed/Flexible Sensors: Their Future and Challenges, Electronic Products, July 2015, http://www.rgrace.com

[7] J. Bryzek, R. Grace; The Trillion Sensors Initiative; Commercial Micromanufacturing International; Vol. 7, No. 2; pp.42-46; http://www.rgrace.com

[8] R. Grace; MEMS Commercialization: From the Lab to the Fab; Commercial Micromanufacturing International; Vol. 2, No. 1; pp. 10-12; http://www.rgrace.com

About the author

Roger H. Grace is president of Roger Grace Associates (RGA), a Naples Florida-based marketing consulting firm specializing in high technology, which he founded in 1982. His background includes over 40 years in analog circuit design engineering, manufacturing engineering, application engineering, project management, product marketing, and technology consulting. He can be reached at 239-596-8738, [email protected].