Sensors are used in electronics-based medical equipment to convert various forms of stimuli into electrical signals for analysis. Sensors can increase the intelligence of medical equipment, such as life-supporting implants, and can enable bedside and remote monitoring of vital signs and other health factors. An aging and expanding population is accelerating the development of new and different types of medical equipment, including various sensors used inside both equipment and patients' bodies. Healthcare organizations want real-time, reliable, and accurate diagnostic results provided by devices that can be monitored remotely, whether the patient is in a hospital, clinic, or at home.

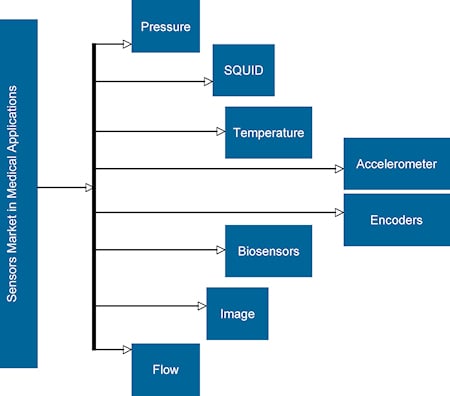

For the purpose of this research we examine how pressure, temperature, flow, and image sensors; accelerometers; biosensors; SQUIDs; and encoders are used in medical applications (Figure 1).

Figure 1. Product types within the medical market |

Key Sensors and Applications

Pressure sensors are used in anesthesia delivery machines, oxygen concentrators, sleep apnea machines, ventilators, kidney dialysis machines, infusion and insulin pumps, blood analyzers, respiratory monitoring and blood pressure monitoring equipment, hospital beds, surgical fluid management systems, and pressure-operated dental instruments.

Temperature sensors are used in anesthesia delivery machines, sleep apnea machines, ventilators, kidney dialysis machines, blood analyzers, medical incubators, humidified oxygen heater temperature monitoring and control equipment, neonatal intensive care units to monitor patient temperature, digital thermometers, and for organ transplant system temperature monitoring and control.

Applications for flow sensors include anesthesia delivery machines, oxygen concentrators, sleep apnea machines, ventilators, respiratory monitoring, gas mixing, and electro-surgery, in which high-frequency electric current is applied to tissue to cut, cause coagulation, dessication, or destroy tissue such as tumors.

Image sensor applications include radiography, fluoroscopy, cardiology, mammography, dental imaging, endoscopy, external observation, minimally invasive surgery, laboratory equipment, ocular surgery and observation, and artificial retinas.

Accelerometers are used in heart pacemakers and defibrillators, patient monitoring equipment, blood pressure monitors, and other integrated health monitoring equipment.

Biosensors find applications in blood glucose and cholesterol testing, as well as for testing for drug abuse, infectious diseases, and pregnancy.

Magnetoencephalography (MEG) and magnetocardiography (MCG) systems use superconducting quantum interference devices or SQUIDs. These highly sensitive magnetometers measure extremely weak magnetic fields and are used to analyze neural activity inside the brain.

Encoders can be found in X-ray machines, magnetic resonance imaging (MRI) machines, computer-assisted tomography equipment, medical imaging systems, blood analyzers, surgical robotics, laboratory sample-handling equipment, sports and healthcare equipment, and other noncritical medical devices.

Market Behavior During the Economic Slowdown

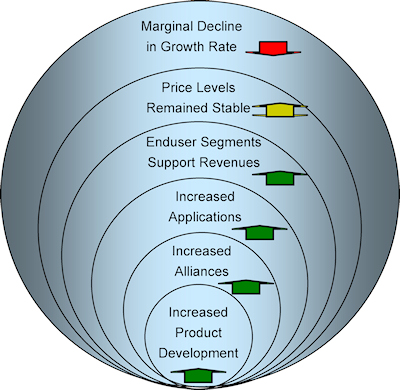

The market for sensors used in medical applications market (Figure 2) was one of the few markets that experienced the least decline in revenue growth rates in 2009. Two key segments—point of care and home diagnostics—accounted for the bulk of the revenue. The applications in these market segments include blood glucose monitoring, testing for cholesterol and cardiac biomarkers, coagulation-related tests, ventilators, X-ray machines, MRI, computer-assisted tomography equipment, medical imaging, blood analyzers, surgical robotics, and laboratory sample-handling equipment. These applications, because of their necessity, were virtually unaffected by economic conditions.

Figure 2. The impact of turbulent market conditions on the sensors in medical applications market (world), 2008–2009 |

Expanding economies in some Asian countries bolstered the market demand for medical devices and instruments. The funds allocated by the respective governments in these countries for promoting healthcare sectors have benefited the medical sensors market. These are two of the reasons that the medical sensors market continued to grow, despite the economic slowdown in 2008 and the first half of 2009 and why the market has continued to exhibit strong growth through 2010 and beyond.

Key Challenges and Market Dynamics

Sensor manufacturers who cater to the medical applications market are charged with meeting the stringent requirements of the medical device industry. While advancements in medical devices challenge sensor manufacturers to keep pace, the manufacturers require long development cycles as most sensor and sensor-based systems go through a long qualification period during which time they are not in routine use, are restricted to specialized sites, and undergo validation trials, mostly within research laboratories. The long qualification period is also needed to be sure that sensors can operate reliably in different medical environments. Implantable sensors, in particular, present technological limitations combined with the need to obtain regulatory approval before use.

There is always a constant pressure to lower prices in the medical sensors market that restricts the development of newer products for existing applications, so R&D spending has a lower priority. Finally, a lack of technology awareness among medical practitioners challenges medical device adoption, requiring greater promotion by the sensor and medical devices manufacturers.

Sensors can increase the intelligence of life-supporting implants as well as enable new types of monitoring to support more independent patient lifestyles. Patients need to be monitored pre-hospital, in-hospital (before, during, and after procedures), at home, in long-term care, and in other locations. It is this constant need for patient monitoring that drives sensor usage because sensor devices can be programmed to process vital-sign data and alert medical personnel when a particular vital sign, such as heart rate, falls outside of normal parameters.

When patient data are collected in a variety of environments—pre-hospital, in-hospital, ambulatory and home monitoring, and database collection for analysis—some of which are informal, there exists a security gap or vulnerability to the data being compromised that has yet to be resolved.

Market penetration of the most advanced products and technologies is always slower in developing and underdeveloped regions as compared to the West. However, as these advanced medical sensors become cheaper and more common, their market penetration is expected to increase in the developing and underdeveloped regions.

Technology Trends

Healthcare professionals want real-time, reliable, and accurate diagnostic results provided by devices that can monitor the patient wherever the patient is located. Medical equipment designers want more than just a sensor. They are looking for integrated functionality to provide equipment with improved performance and reliability, and at a lower cost.

Because sensors are functionally sophisticated, small, robust, and don't consume a lot of power, they are a natural choice in medical equipment design, particularly in smaller, portable, noninvasive equipment such as pulse oximeters, personal heart-rate monitors, and blood glucose meters. Their small size also means that more space is available for placing other components or features within a medical device. Smaller sensors also allow sensor placement in space-constrained areas, such as inside a device or inside the human body. For example, in traditional endoscopes, image sensors are placed at the back of the assembly and are never in contact with the human body. Light travels through the light guide of the rigid endoscope or fiberscope then back to the image sensor where the images are processed. Modern endoscopes, because the image sensors are so small, place cameras at the tip of the endoscope.

The addition of integrated functionality within the sensor eliminates the need for subsystem circuit designs and shortens the design cycle. The design strategy of pairing different sensing technologies to enhance functionality is also a growing trend. For example, incorporating temperature sensing into MEMS devices allows for real-time temperature compensation. Integrated sensors provide medical professionals with quick and accurate diagnosis and analysis.

Looking toward the future, sensors for use in the medical device industry will need to be able to perform diagnostics. The market is also demanding that the sensor be able to test itself for compliance and functionality.

MEMS Sensors

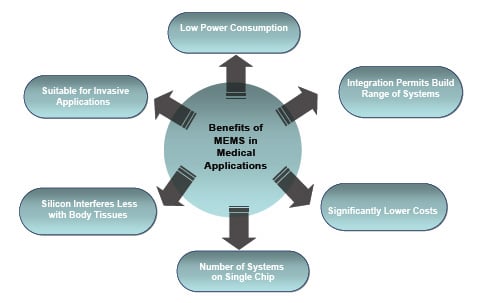

MEMS sensors offer several benefits that support the increasing penetration of MEMS technology into the medical applications market (Figure 3). MEMS sensors are typically low power, their silicon interferes less with body tissues, integration permits a large number of systems to be built on a single chip, and their small size enables less invasive (and therefore less painful) instruments.

Figure 3. The benefits of MEMS technology in medical applications |

For instance, MEMS accelerometers can alert medical professionals when a patient falls. Elderly patients, in particular, may suffer serious injuries from an unobserved fall. Wearable, intelligent devices equipped with MEMS inertial sensors can be used to detect and assess the severity of a fall and signal for help, aided by a GPS to provide location information.

Precise control of the scalpel is an important requirement in any surgery. MEMS pressure sensors can be incorporated into the scalpel where they measure the force exerted on the tissues and provide feedback to the surgeon about scalpel pressure.

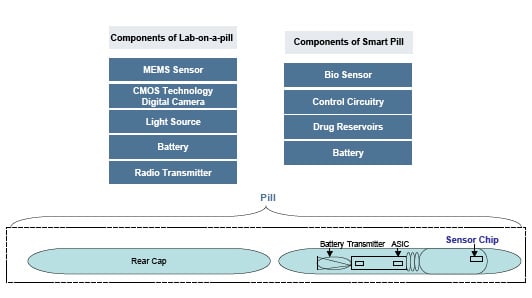

MEMS sensors are one of the components in the lab-on-a-pill (Figure 4), which samples body fluids and picks up patient data such as temperature, dissolved oxygen levels, and pH. An incorporated image sensor allows the device to show a view of the entire small intestine, which can aid in early detection of colon cancers.

Figure 4. MEMS sensor technology in the lab-on-a-pill and smart pill |

Similarly, the smart pill is a highly specialized MEMS micropump that can be implanted in the human body for monitoring and medication dosage control. Its biosensors sense the substance to be measured, such as insulin, and the pill releases the drug once the quantity of the substance falls below a certain amount required by the body

Implantable Sensors

Implantable sensors and/or active monitoring devices are already used in the healthcare arena for continuous monitoring, administering drugs to patients, and to control some vital organs within the patient. The trend is to move from a limited range of passive, implantable medical biosensors and monitoring devices to active implantable devices. Implantable biosensors can test for indicators of disease/symptoms and regulate the release of a drug to help treat the disease. For example, implanted blood glucose sensors could be coupled to an insulin release system, allowing patients to control their blood sugar without pinprick tests or insulin injections. Over the forecast period, we expect wider adoption of implantable medical sensors feeding data to electronic health record (EHR) and personal health record (PHR) systems.

Energy Harvesting

Manufacturing, logistics, automotive, consumer electronics, toys, defense, and homeland security are some of the potential markets for energy harvesting. We also predict a large potential market for self-powered, implantable medical devices where, for instance, body heat is harvested to power a wireless medical sensor. Similarly, by converting body movement to mechanical energy and muscle stretching into electricity, nanogenerators could produce a breakthrough class of self-powered, implantable medical devices.

For example, Biophan Technologies' subsidiary TE-Bio has developed a biothermal power source that converts body heat into electricity to power implantable medical devices. NASA has engaged TE-Bio to develop high-density, nanoengineered thermoelectric materials for use with implantable medical devices.

Biosensors

Research and development in biosensors has been robust, resulting in new biosensor types, including a high-precision multiple-test biosensor that has recently been introduced. One of the key features of the biosensors market has been a large number of alliances and licensing agreements entered into in 2009.

Precision is the most preferred product attribute and a very important competitive factor. In terms of distribution, point-of-care and distributors (retail distribution) are the most viable channels. Among end users of biosensors, the largest groups are individuals, patients, and point-of-care institutions and this will continue to remain the case through the forecast period.

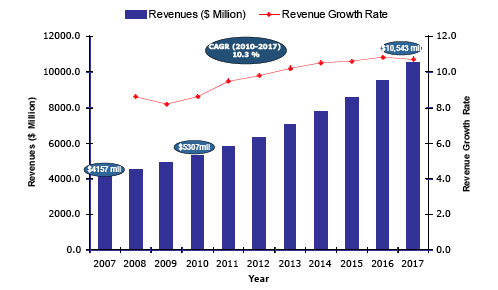

Market Revenues

We expect increasing revenue growth in the market for sensors in medical applications due to a number of factors: the constant demand from the healthcare sector for better and improved care; the increasing importance of sensors in almost all medical devices; further developments in sensor technology; and newer medical applications for sensors (Figure 5).

Figure 5. Market revenues 2007–2017 |

This segment of the overall sensors market is highly competitive, with a low to medium threat from new entrants. A number of market participants are active in different product segments, with several companies specializing within individual product segments. However, only stable companies with technical expertise in sensors for medical applications have good prospects in catering to the medical industry.

Biosensors contributed the bulk of the sales increase. Because sensors are critical components in medical devices, the absence of substitutes makes the threat to the existing product line low. In addition, the level of technology is continuously improving, which is likely to sustain high demand.

Closing Thoughts

Medical devices are taking advantage of the technology convergence. MEMS sensors made for automobiles are now being used for healthcare devices such as heart monitors and 3D motion tracking. There is a great interest in trying to monitor the activity of people who are at medical risk using remote or implantable sensors, and the insertion and management of artificial devices implanted within the human body is expected to become increasingly common.

This market undergoes constant R&D work. For instance, the National Institute of Health (NIH) Roadmap of Nanomedicine Initiative expects that, in the next 20 to 30 years, nanosized implantable solutions will be developed with the ability to receive, store, transmit, and act on information. Continued innovation in sensor components and technology, such as packaging design and device miniaturization, enables a host of new medical applications that save lives and improve quality of life.

Sensors for medical applications are expected to see developments in the following areas: inherent accuracy, intelligence, capability, reliability, small size, power consumption, packaging, cost, and the elimination of lead. Developments are expected to be mainly in the areas of MEMS and nanotechnologies. Market challenges include regulatory compliance, extended product lifecycles, reduced product development time, and product safety.

Medical device design often is centered on the integration of some novel sensor and application of the acquired data. As medical monitoring and treatment equipment shrink for use in the home, even to wearable or implanted form factors, sensors will also shrink in size, and fixed and durable medical sensors will gradually give way to disposable ones.

ABOUT THE AUTHOR

Dr. Rajender Thusu is Team Leader—Sensors, Measurement & Instrumentation for Frost & Sullivan, San Antonio, TX. He can be reached at 210-247-2498, [email protected].