Intro & Situational Analysis

This is the sixth of an eight-part episode tutorial on the topic MEMS and Sensors Marketing, Oxymoron or Opportunity. The topic of this episode, Market Research: Past Failures and Future Opportunities, and the associated challenges.

As new applications for MEMS and sensors surface and MEMS and sensors are becoming more ubiquitous, market research firms have stepped up their activities to support these opportunities. High level firms including Lux Research and Gartner now have sensor specialists on their staff of analysts. Historically, MEMS market research was conducted by a couple of market research organizations who produced and sold reports dealing with market size values and growth rates broken into segmented application/technology areas.

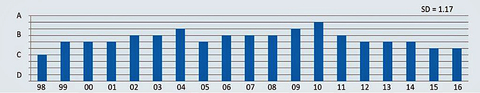

Detailed market research was primarily conducted in-house by marketing teams familiar with the product and its applications or vis-à-vis technology marketing organizations. The Roger Grace Associates market study, MEMS Industry Commercialization Report Card, has tracked the topic of Market Research since its inception in 1998 with market research being one of the 14 critical success factors tracked by the Report Card (fig. 1)

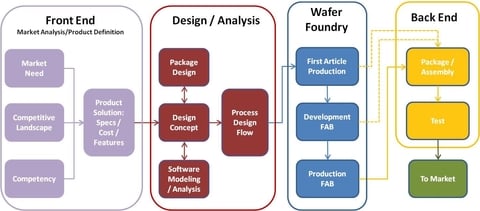

Market research is one of the most overlooked tools in the MEMS/sensors industry. As can be seen in the MEMS Commercialization Process of figure 2, market research plays a major role in the front end of the process where it is used to define the customers’ unfulfilled needs (vis-à-vis listening to the voice of the customer), assess internal competencies and finally to determine the competition’s strengths and weaknesses as compared to one’s own.

In the back end of the process where the product/service is ready to be offered to the market, market research can be used to judiciously determine the best means of product chains of distribution and, most importantly, promote the product to market. Product and company positioning and branding also must come out of diligent market research to be defensible. More on positioning and branding in a future episode.

Robert Cooper in his Winning with New Products book [1] showed that inadequate market analysis has been shown to be the major cause of new product failure as stated by 24% of the companies queried. This was followed by problem products or defects (16%), lack of effective marketing effort (16%), higher costs than anticipated (10%), competitive stretch or reaction (9%)poor timing of introduction (8%), technical or production problems (6%) and others (13%) [1]. (figure 3).

24% of the companies queried. The next closest was product problems or defects at 16%.

I would like to kick-off the several outside contributions from my MEMS and sensors sales, marketing and executive management colleagues to this episode with a quote from Tom Peters’ book, “In Search of Excellence” [2], in which he states that the best market research is done with real products and with real customers. This comment is highly corroborative with several of the comments of the interviewees of this episode and with the comments of interviewees from my previous Episode 1 on listening to the voice of the customer.

Discussion

Again, there was major consensus on MEMS/sensors-specific market research issues derived through our interviews.

Gary Winzeler, a 35 plus year veteran of MEMS and sensors sales and marketing and the VP of Sales and Marketing at DunAn Sensing said, “Market research is many times thought of as detailed reports that you purchase with reams of data and global perspectives. While this is useful at DunAn Sensing, we tend to favor the process of design thinking (figure 4). We work directly with our customers to understand, explore and materialize the products that they need. The voice-of-the-customer is really what we want to hear. Engaging as many stake holders as possible and collaborating with each of them on a one-on-one basis is crucial to turning out successful new products that will make sense in today’s market.”

techniques as a critical first step. The process sets out to understand, explore and materialize new product creation.

“As a start-up company, we had the choice to start with a product based on the competition or to invest more time to research and fully understand the customer and their application needs. Our first market application sector focus was the heating, ventilation, air-conditioning and refrigeration (HVAC/R) market to measure the pressure of the refrigerant. We identified the leading HVAC/R manufactures in the USA and began to research and understand the customers' problems that existed. As a result, we have recently developed and successfully introduced the industry’s leading pressure transducer for the refrigeration market.”

The TP Series temperature and pressure product subsequently has been successfully sold to several targeted customers and was awarded as one of the better products of 2017 at Sensors Midwest Expo 2017, Rosemont, IL. The voice-of-the-customer was a key factor to the development of this product and in achieving the award.

Steve Whalley (former Intel director and MEMS and Sensors Industry Group CSO) said, “Available MEMS market research is too near-term and just an extrapolation of previous years. For market research to be more valuable to marketers, it must be more forward looking. Market research starts by understanding the ‘sandbox’ you are playing and competing in. A thorough environmental scan of what your market looks like today and the trends for the future is imperative before anything else.”

“This can be done by lots of reading, attending trade shows and networking. Know who your true competitors are and what differentiating features you have over them. Obviously, get as much input from your potential customers, partners, and suppliers as you can before finalizing any product. When I say product, I do not just mean the piece of software, hardware, component, etc. that you may be developing. You need to have a complete end-to-end systems solution approach these days even if you are not creating all the elements yourself.”

“For example, we know Data Analytics and Artificial Intelligence will be key tools for the tsunami of data being generated by MEMS and sensors today. How will your company utilize these tools and participate in the revenue generation they provide? Don’t leave money on the table here. Also, you need to know the ecosystem you are entering and what elements of it are in place and what need to be created for your product to successfully launch and take off.”

“You cannot do it all but you will need to identify the gaps and work with others to fill those gaps. If you can, build prototypes quickly and often to get key customer feedback before that final launch. Continue to evaluate where you are every few months and what potential course directions need to be made given the pace of change these days. If all the above product solution and ecosystem details come together then it makes the traditional, and even not so traditional, marketing techniques all the easier to execute on.”

Janusz Bryzek, Ph.D. a 40-year veteran of MEMS/sensors and the leading MEMS serial startup entrepreneur and CEO of eXo Imaging stated, “Most of market research is based on interviews with production leaders and extrapolation of past market data, mostly using linear extrapolation algorithms. Neither of these two approaches can factor-in revolutionary developments nor developments based on exponential technologies. Market research can be segmented into existing and new markets, served by linear and exponential technologies. The accuracy of traditional market research approaches varies greatly for these four segments (figure 5).”

A variety of techniques had been developed for traditional markets research, for example interviews with producers and customers, and extrapolation of the past market data. These techniques yield good results for existing markets served with linear technologies, but fail for new markets and exponential technologies.

New markets and exponential technologies suffer from Low/No-Data, making forecasts difficult. Two techniques have been used to create reasonable forecasts:

- Informed Intuition

- Interviews with visionaries

Informed Intuition to define new markets is the technique outlined in Geoffrey Moore’s books on Crossing the Chasm. It is based on inviting groups of smart people to “invent” applications for the disruptive technology. These applications are then sorted into several categories, including must-have and nice-to-have features for certain categories of customers. If found, must-have is the strongest product attribute justifying creation of a new market, and nice-to-have is the second strongest. If not found, the process is repeated with another group of smart people. Demographics of found customer categories defines the total available market, and historical adoption curves of prior technologies for these customers could define the potential market growth rates.

Interviews with visionaries is another powerful market research tool for new markets and exponential technologies, as they have the closest vision of the future. One of the world’s best technology visionaries is Ray Kurtzweil. Of the 147 predictions that Kurzweil has made since the 1990's, fully 115 of them have turned out to be correct, and another 12 have turned out to be essentially correct (off by a year or two), giving his predictions a stunning 86% accuracy rate.

In the MEMS field, TSensors Initiative invited over 200 visionaries to talk about the emerging ultrahigh volume (trillions) sensor applications and technologies, discovering the following new markets with potential for trillions sensor-based Internet nodes between 2025 and 2035:

- Unobtrusive health monitoring.

- Global environment monitoring.

- Monitoring global disasters and aging infrastructure.

- Food production and conservation.

- Clean energy generation and conservation.

- Printed electronics enabling low-cost fabrication of all the above.

Wilfried Bair, 30 plus year sales, marketing and executive manager veteran of the MEMS and IC industry and Senior Engineering Manager at NextFlex said, “The reasons for buying a market research report vary by business type and the development stage of the target market. To simplify the view on market research reports, I generally put them into two categories: emerging markets and established markets.”

“For early stage and developing markets, using market research to justify investment into new technologies that will serve up and coming markets makes sense. Publicly traded companies heavily rely on external market reports as a third-party reference for their internal findings to assist in decision making about whether to enter specific markets and the timing of their market entry. Risky investments in new markets that are made prematurely are an expensive undertaking when the market opportunity does not align well with profitable revenue returns.”

“Market research on emerging markets tend to predict a hockey stick curve for revenue forecast, and in many cases also predict optimistic margin estimates. Companies invariably find, for a multitude of reasons, the hockey stick curve shifts to the right when the report is updated a year later – thereby creating the “Valley of Death” for new technology commercialization. An opportunity for market research focused on emerging markets is to provide deeper analysis on trends and provide further granularity on the inflection points of market adoption.”

“Market research on established markets, on the other hand, typically delivers extensive and detailed market data, a detailed competitive comparison and a reliable market outlook that utilizes a well-oiled machine of an extensive network of analysts. Despite the deep resources of many market research organizations have, it seems that new and disruptive technologies that threaten the traditional markets are often presented at a very late stage. A tremendous opportunity for the field of market research would be to cover disruptive trends at an early stage, even if there is no visible revenue impact. This means being smart about picking the most promising new market entrants”.

Paul Werbaneth, Global Product Marketing Director, Intevac, Inc. and 25-year veteran of marketing in the MEMS and IC industry said, “Listen to what the market says. It may sound simple, but many, many technologists approach market research with a bad case of confirmation bias, tending to only hear market voices when the voices reinforce existing beliefs, rather than truly listening to the market and heeding what the voices say, particularly in the case where established beliefs are challenged”. Going to the well for a swig of unfiltered Voice of the Customer (VoC) sounds as if it should be straightforward – just dip your ladle into the bucket of opinions you’ve hauled up from the depths, then sniff, swirl, and swallow.”

“We can’t help, as humans, being creatures of routine habit; it works, and got us to where we are today. (Good or bad though this place may be.) Market research protocols employed commercially by such famous names as Nielsen, IMS Health, and J.D. Powers provide trusted results because they are protocols, i.e. official procedures, and because they are bankable as a result, although we may cringe remembering famous well-researched product launch failures, from the rollout of New Coke, years ago, to the rise and fall of Juicero, Silicon Valley’s flash in the pan ca. 2017.”

“In an industry with only two customers, for example the hard disk drive industry, it makes sense to follow market research protocols that provide basic market updates, rather than ones that try to blaze brand new characterizations, because we know hard disk drive, we know the HDD roadmap, and we know the individual players in HDD, from the C-Suite on down. Injecting a bit of anarchy in our market research work in that market, just as injecting a bit of Épater la bourgeoisie in anything J.D. Powers does, hardly makes sense, or doesn’t make sense maybe until HDD becomes SDD, or until driving your own automobile goes the way of driving your own surrey.”

“I propose introducing a bit of Dada spirit into the market research proceedings. Find a different well! Or go to a spring instead. Plumb another depth or two; use a different ladle. Swallow before sniffing. It could lead to a new, and original, sensibility regarding VoC. This can work in the MEMS market, with its still long tail, with its many new wells to sample, and with its fresh new springs, in a way that wouldn’t at all be appropriate for understanding HDD. By breaking up the protocol, the market research routine, find, in the words of Tristan Tzara, ““Not the old, not the new, but the necessary.”

Sandeep Akkaraju (eXo Systems) says, “Market research and market researchers need to take a more holistic view of the market…they do not look into the future and thus there is too much extrapolation.”

Steve Ohr (former Gartner analyst) claims, “It is my experience that conducting market research in the Sensors/MEMS area is much more difficult that it is in the IC market since many of the IC companies are public versus only a couple of MEMS/sensor companies. A handful of large companies make up the majority of sales in ICs where as in the MEMS/sensors, there are many even though there are a couple of giants like ST Microelectronics and other IC companies that also produce MEMS do not segment the MEMS contributions to sales. Many of the IC companies are public and have to conform to US Security and Exchange Commission (SEC) rules which provides guidance on reporting income.”

“Additionally, there is major segmentation in the sensors area from both a sensor type e.g. acceleration, pressure and an application diversity perspective. This makes accurate market research an immense undertaking. Finally, it is quite challenging to conduct accurate market research in disruptively innovative (Wikipedia def: one that creates a new market and value network and eventually disrupts an existing market and value network displacing existing leading firms, products and alliances) markets including wearables, IoT and autonomous vehicles.”

Maryann Maher, Ph.D. and CEO of SoftMEMS thinks, “We are a supplier of design and simulation tools to the MEMS ecosystem. As such, we see market research as a valuable tool for product planning, assigning resources and understanding required expertise in our workforce. We work across all application areas of MEMS, so understanding the relative market sizes and maturity of markets is extremely important to us in developing new features in our computer aided design (CAD) tools. The type of software we bring to market in a particular application area depends on whether a market is mature or in a heavy research and development phase. We use market data such as ASP (average selling price), information on product multi-chip/system integration and packaging strategy, key players segmentations and market size in our planning. A challenge that we see with market analysis is the ability to accurately predict the timing and market size of new markets and applications for example in the areas of RF MEMS and various bioMEMS based markets.”

Summary & Conclusions

Once again and on this topic, there was significant interviewee consensus on the topic of MEMS and sensors marketing. Some of the highlights were:

- Market research is a critical element in both the “front end” and “back end” of a successful MEMS and sensors commercialization process.

- The best market research is done with real products and with real customers…T. Peters …In Search of Excellence [2]

- 24% of new product failure is caused by inadequate market analysis …R. Cooper…Winning with New products [1]

- Listening to the” voice of the customer” is the most effective way to better understand customer needs (please refer to Episode 1 in this tutorial series). (I will further address my experience with various ways to effectively accomplish this in a future episode as I have done so in passing in Episode 1).)

- Most published market research is an extrapolation of previous performances of emerging (and trackable) market but does not properly address disruptive markets

- For “early”/” immature” markets…to provide deeper analysis on trends and provide further granularity on the inflection points of market adoption and cover trends at an early stage, which requires being smart about picking the most promising new market entrants.

- Market research and market researchers need to take a more holistic view of the market; they do not consider the future and thus there is too much extrapolation.

Also, you may want to put this one-hour webinar, MEMS and Sensors Marketing: Oxymoron or Opportunity, on your calendar for February 13, 2018 from 1:00 to 2:00 PM EST.

Acknowledgements

The author acknowledges contributions by the following individuals:

- Sandeep Akkaraju, President /eXo Imaging (Formerly: CMO Jyve)

- Robert Andosca, Ph.D. CEO / Inviza (Formerly: CEO microGen)

- Matt Apanius, President and Managing Director/ Smart Microsystems

- Wilfried Bair, Senior Engineering Manager/ NextFlex

- Janusz Bryzek, Ph.D., CEO/ eXo Imaging (Formerly: CEO Jyve)

- Juan Figueroa, Ph.D. CEO/Abenaki Connect (Formerly: SBIR Program Manager/National Science Foundation)

- Alyson Hartzell, Managing Engineer/ Veryst

- Brian Kinkade, Founder/Positive Impact (Formerly: Marketing and Sales VP, Spec Sensors)

- Jim Knutti, Ph.D., CEO/ Acuity Inc.

- Mark Laich, CEO/Laich Advisory Group, (Formerly: VP Sales and Marketing/ MEMSIC and V.P. Business Development /Qualtre)

- Keith Myers, V.P. Marketing/ TE Connectivity

- Tom Nguyen, CEO/ Dun An Sensing

- Rob O’Rielly, Consulting Engineer/ Analog Devices

- Rick Russell, President/Merit Medical

- Steve Ohr, Semiconductor Industry Analyst and Reporter (Formerly: Semiconductor and Sensors Analyst/Gartner)

- Kurt Petersen, Ph.D., Member/Silicon Valley Band of Angels (Formerly: CEO/SiTime)

- Paul Pickering, V.P. Business Development /Micralyne

- Swaminathan (Swami) Rajaraman…, Ph.D., Assistant Professor/University of Central Florida

- Steve Walsh, Ph.D., Professor/University of New Mexico

- Paul Werbaneth, Director of Marketing / Intervac

- Steve Whalley, Whalley Consulting (Formerly: MEMS and Sensors Industry Group/Chief Strategy Officer)

- Gary Winzeler, V.P. Sales and Marketing/ Dun An Sensing

About the author

Roger H. Grace is president of Roger Grace Associates (RGA), a Naples Florida-based marketing consulting firm specializing in high technology, which he founded in 1982. His background includes over 40 years in analog circuit design engineering, manufacturing engineering, application engineering, project management, product marketing, and technology consulting. He can be reached at 239-596-8738, [email protected].