Welcome back to my eight-part tutorial series on Sensors/MEMS Marketing: Oxymoron or Opportunity. Episode 7 will address one of my favorite topics...Integrated Marketing Communications (i-MARCOM). And as an added topic, I will include some additional important information on market research as a carry -over from Episode 6.

If you have not had a chance to see the previous episodes…they are listed below and can be accessed by going to www.rgrace.com/MEMS

Episode 1: Listening to the Voice of the Customer

Episode 2: The Role of Marketing in the Funding Process

Episode 3: Is the “Shine” off of MEMS

Episode 4: Insider Tips for MEMS/Sensor Marketers

Episode 5: Putting the “s” back into MEMS

Episode 6: Marketing Research: Past Failures and Future Opportunities

MARKET RESEARCH (CONTINUED FROM THE PREVIOUS EPISODE) …INTRODUCTION

Let’s get started by reviewing two additional inputs for sensor/MEMS industry pundits. My dear and long-time friend, Prof. Steven (Steve) Walsh of the University of New Mexico provided a most interesting and informative input. Steve is an esteemed Management of Technology Professor and is well known for his exemplary contributions to the worldwide MEMS community. He started his career as a bio engineer having graduated from RPI school of engineering and went on to receive an MBA and Ph.D. in Management from NJIT. Steve and I (along with Job Elders of the Netherlands) were the co-founders of the Micro and Nanotechnology Commercialization Education Foundation (MANCEF) approximately 15 years ago and have established the annual and popular international Commercialization of Micro and Nanotechnology Conference (COMS). Steve also championed the creation of the MANCEF MEMS and Nanotechnology Commercialization Roadmap [1] [2] of which I was a significant contributor to the marketing chapter. Certainly, this document is considered one of the most valuable contributions to the MEMS commercialization process. In his early days, Steve worked as a market research professional at Proctor and Gamble…and certainly knows, and from first-hand experience, the “ins” and “outs” of market research. He has specialized in the topic of “disruptive technologies”. As you may recall in Episode 6, several of the contributors addressed the difficulty in making accurate estimates of market size in disruptive markets.

DISCUSSION

Professor Steve Walsh said…” Some sensors and MEMS- based markets are now much more mature than they once were so they lend themselves to traditional marketing research techniques. For these markets, the best techniques are developed from a combination of “top down” and “bottom up” techniques which are both quantitative and qualitative in nature. This includes just about all of the non-S curve quantitative techniques such as economic modeling, single and multiple regression, times series modeling and trend regression.

Marketing research is difficult to conduct on emerging markets. These are often the basis of the current complex market research techniques that are employed. They provide a quantitative technique which to some improves believability but requires current products, current customers and extrapolating from current sales. These techniques are most advantageously to steady state markets and as MEMS has “grown up” are more in vogue. These techniques are useful in road mapping where the underling manufacturing technology is known and stable as in the case of surface semiconductor microfabrication.

These techniques, however, do little for emerging technology product paradigms. By definition, there are no or few customers and other techniques are much better in this case. Therefore, most marketing research firms do not predict or indicate the next “blocking product” for either traditional or emerging technology based products. The technique here are much more focused on lead user based techniques. These techniques are underpinned by Technology Forecasting techniques like; technology development systems, scenario analysis, technology monitoring and the like. They are focused on predictive analysis techniques and always require both qualitative and quantitative techniques. This requires the analyst be much more familiar with the new product development process and the customer development process. These techniques emphasize analytical techniques developed by Roberts, Bayous and others and are more focused on logarithmic or exponential growth. These are the techniques that might better underpin 2nd generation road mapping techniques like disruptive technology road mapping, SiP or landscaping. As our field has grown we have moved more to traditional techniques and we are emulating more traditional industrial techniques. This however, comes with a cost”.

Also to be heard from is my dear friend and colleague Brian Kinkade who has served as a sensor and MEMS marketer for over two decades with several companies. Brian said…” For me, market research reports serve to document the current state of a particular market and the common understanding of future market growth. What the reports are usually excellent at providing are the current major players, new entrants, vocabulary used in that industry, the typical aspects of competition (or product differentiation), and the structure of the market. (e.g. product technologies, market segments, ecosystem/supply chain). However, when reports are based on surveys of the market leaders, they represent what the leaders want to discuss. This can sometimes limit the fidelity of the report especially regarding forecasts. Specifically, the analyst must ensure they do not “double-count” the market opportunities where more than one market participant expects to win. I also believe most market research reports can get the growth rate wrong. This is because considering all possible market influences is a complex task. It can be especially difficult for MEMS/sensors because they are at the bottom of the supply chain and there are different market influences at each level. I think it would be interesting to measure the “forecasting performance” of various market research analysts. One might start by reviewing their previous forecasts and seeing how well they did. If we did this consistently across the market research report providers and made the results public, eventually there might be better forecasts”.

I find Brian’s comment most interesting and appropriate. I believe that looking back and reviewing the previous projections of the various marketing research firms who publish market reports on market size and growth as a function of time and assessing how accurate they were would be most interesting and valuable to the sensors/MEMS community. To this end…any market research firms wishing to provide me with their historical inputs would be appreciated. I would be happy to author a follow-up article in this publication addressing their success (or lack thereof) of these projections.

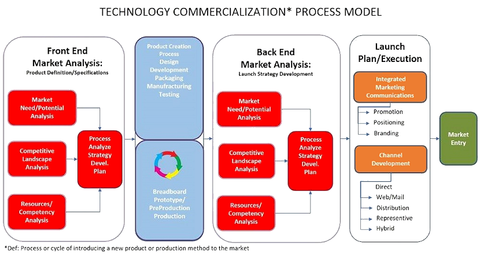

In summary on the topic of market research, it is an all-pervasive tool that can unlock many treasures for the sensors/MEMS marketer. In addition to its well-known function and popular usage in the commercialization process front- end to assist marketers to better understand the user unfulfilled needs, competitive situation and internal organizational competencies, its value in the back- end is immense…and quite frequently undervalued and/or overlooked (see figure 1).

I have used market research frequently in assisting my clients in planning and implementing integrated marketing communications programs (to be addressed following) to best understand their optimum positioning, branding and promotion activities. Here a thorough understanding of my clients’ competing organizations’ position, branding and promotion is critical. We achieve this by conducting a rigorous web-based data mining program as well as conducting personal interviews with target potential customers.

INTEGRATED MARKETING COMMUNICATIONS…i-MARCOM…INTRODUCTION

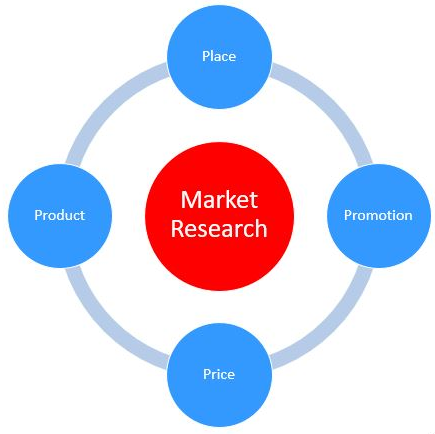

From my over 40 years as a technical marketer and with 35 of these as an independent marketing consultant, I can say without a doubt, that i-MARCOM is one of the most underused and highest ROI elements of the marketing mix. Def: the marketing mix is a set of actions or tactics that an organization uses to promote its brand or product in the marketplace. The four “Ps” make up the marketing mix…product, price, promotion and place.

The accurate understanding of these elements is best accomplished using market research (see figure 2). To me…the judicious use of i-MARCOM and market research are critical to the success of any sensors and MEMS organization and I proselytize their adoption to all my clients to whom I provide marketing services.

I consider them to be the marketers’ “secret weapons” [3]. I-MARCOM embraces the critical marketing elements of:

- Positioning: defined as the place that a product/service/organization occupies in the consumers’ mind that relates to competing products/services/organizations from other products/services/organizations. This concept was originally proposed by Trout and Reis in their book bearing the same title [4]

- Branding: defined as the marketing practice of creating a name, symbol or design that identifies and differentiates a product/service/organization from other products/services/organizations

- Promoting: defined as the process of communicating the attributes of the product/service/organization to the target audience(s) as well as better providing information for a better understanding of the pros and cons of the various sales/distribution channels available to acquire the product.

And within these elements…I believe that the most highly leverage “tools” that optimize the marketers’ ROI include:

- Public Relations including feature article contributions

- Trade show participation including presentations at and editor meet-ups, market research and product launching during the event.

- Webinars

- White papers

- Technical collateral

- Social media including email “blasts”

These tools need to be employed synergistically as part of the “back- end” of the commercialization process and are most valuable in the creation of the firm’s holistic strategic messaging strategy and integral to its positioning, branding and promotion as well as in the supporting of the distribution channel(s) as mentioned above. They need to work in synergy with each other and be driven by an all-encompassing plan to ensure that the strategic messages are consistent, coherent and correlative. Furthermore, I believe that that a key element to a successful i-MARCOM campaign is that it must be educational / tutorial in nature. Thus…the title of “tutorial” for this series of editorial program episodes.

Being an engineer, I am one who believes that an educated consumer is a happy consumer. This tenant applies from purchasing cabinets for your home’s kitchen renovation to selecting an ASIC vendor for your sensor-based system. Knowledge is power and the successes in the sensors/MEMS supplier community are the ones that help their clients intelligently maneuver through the maze of options available and help them design their systems without designing it for them….and insuring that your company’s products/services are included as an integral part of the overall solution. N.B. engineers, being engineers, tend to be “territorial” about their designs and don’t want others designing their systems for them unless they explicitly ask.

My recommendation as to the strategy to establish a defensible positioning in the creation and execution of a successful i-MARCOM campaign is that it must include the concept of the organization becoming the “recognized spokesperson” of the technology that they possess and that it must be defensible throughout the campaign and provided with adequate resources. We have previously heard several people comments on the benefits of employing these i-MARCOM tools in Episode 4. We will take a fresh look at these here. And I will share some of my many experiences with you on this topic including two relevant case studies.

DISCUSSION

Gary Winzeler (DunAn Sensing) said…” In my many years of sales and marketing, I believe i-MARCOM to be very necessary especially in today’s global market places. Not having a good i-MARCOM plan today is like trying to stream Netflix with a 300-baud modem, remember those days, (1MB file would take over 7 hours). So, what’s a good i-MARCOM plan? There are many necessary components but a few main ingredients are:

- good marketing research that understands your customer and includes “the-voice-of-the-customer”

- having a planned-out campaign that Mirrors “the-voice-of-the-customer”

- having an expert connection (not a 300-baud modem) to the publications, editors, trade shows, social media - this can be an experienced employee or more likely a consultant

- be creative and open to new and different approaches

Another aspect of i-MARCOM is your sales force, we use manufactures reps and they see our presence and activity in the market place and they are eager and excited because leads are generated and this helps to shorten the sales cycle”.

Matt Apainus (Smart Microsystems) said…” We developed our marketing communications strategy by using the voice of the customer to understand a gap in the market place. Packaging, assembly, and test of new MEMS products is very challenging and few organizations offer this as their core business offering. This information was collected in a formal market analysis study conducted by Roger Grace Associates. As a result, two primary strategies were created to position SMART Microsystems in the market place – 1) develop a brand using a website and creative messaging that emphasizes that SMART Microsystems is a technology leader, and 2) selectively attend technical conferences and trade shows to establish a presence in the context of competitors while creating opportunities to interface with potential customers. It is important to know that technical people like to do their own research. So instead of “selling” as a tactic, customers tend to engage more quickly when they are “provided information” and have a “technically savvy person” to speak with when they do engage.”

Paul Werbaneth (Intervac) said…” Marketing Communications, MarCom, always used to have for me a certain asynchronous flavor; we would push out a message, using the available channels at the time, and wait (and wait) for an echo. If there was indeed an echo. Often it seemed the world was anechoic, leaving the marketer to wonder into what obscure corner of the universe his carefully crafted message had come to rest, sad one-way travel which could hardly be called communication, implying, as “communication” does, that customers should be coming back over the net to you with their spin on what you sent. Thank goodness for the new channels then! We may miss our old world of glossy industry-specific magazines, delivered every month, with their return-this-card-for-more-information tear-outs, but why look back - the marketing communications environment today has so much more to offer in terms of immediacy, of being right there with our customers on Twitter, and LinkedIn, and Facebook (if you use it for B-to-B), that it’s hard to be too nostalgic. I’m still going to publish a 2500-word piece in Industry Today – but I’m not just going to publish that piece in IT and wait for something to happen. I’m also going to post my piece on LinkedIn, tweet about it, use it for a webinar, and maybe cut a short video based on what I wrote for our YouTube channel. Not only that, I’m going to respond to every customer who retweets, or comments, or who likes or shares my posts. And I am going to do that in real time. Marketing Communications as true communication. Multiple ways of engaging, and almost all of them free. I’m certain this a new Golden Age. Join the conversation!”

I am a major advocate of public relations (PR) as a cost-effective vehicle to gain awareness, build preference and support the development of positioning and branding and I am quick to make this recommendation and plan and implement a program (see case studies below). Another main contributor to the success that i-MARCOM can play in the marketing mix are trade shows/technical exhibits. At these events, many worthwhile activities can effectively take place because of the concentration of editors and potential customers. Chief amongst these are:

- Exhibiting your products/services and meeting customers

- Making presentations at the technical conference

- Heightening the anticipation of attending the conference and soliciting booth and conference visits vis-à-vis pre-conference email blasts

- Launching new products

- Meeting editors either one-on-one at the booth or press rooms or conducting a press conference

- Conducting market research on your product/service vis-à-vis in-booth interviews or at a nearby hotel room or market research facility

- Entering “Best of Conference New Product” competitions

I have used these items with exceptional success with virtually all my clients and highly recommend their use them to the sensor/MEMS marketer. Episode 4 provides substantiation of my kudos by several interviewees.

CASE STUDIES

The lion’s share of Episode 7 was given to the topic of Integrated Marketing Communications… i-MARCOM. I have been a major advocate for the embracing of this approach from my early years as the Marketing Manager of Foxboro ICT…almost 40 years ago and continuing my enthusiasm to this day. I will address two examples of the value of planning and implementing i-MARCOM campaigns which resulted in major successes for my clients.

NovaSensor…MEMS pressure sensors

I experienced exceptionally favorable results in one of my early marketing consulting engagements at NovaSensor (Fremont California), considered to be a pioneer in MEMS industry, where the use of i-MARCOM brought extraordinary and highly leveraged benefits to this startup company which was started in 1988. The startup team of Dr. Janusz Bryzek, Dr. Kurt Petersen and Mr. Joe Mallon supported my recommendations and provided the resources (especially their time, passion and expertise) to create a perceived bigger-than-life company in a short period of time. This was truly exceptional on their part considering that this was a start-up company with three highly technical founders at the helm.

We created several tutorial papers and had them published in leading technical journals as well as made several presentations at the newly created Sensors Expo. The most interest issue was that NovaSensor did not even have a product at the time…instead we proselyted the inherent benefits of Silicon “micromachined” sensors to the sensors community. Because of implementing the i-MARCOM campaign, the results were so favorable that were quickly considered the “gurus” and “darlings” of the “micromachined sensors” business and captured the spokesperson person for the industry (now called MEMS).

We achieved significant coverage in many technical publications including a 16-page story in IEEE Spectrum, mentions in major business publications including Business Week and Wall Street Journal and appearances in several national TV programs and the winning of the prestigious R&D 100 award. This success was based on the exceptionally successful public relations campaign that Roger Grace Associates created and implemented as well as several very successful product launches at Sensors Expo as well as other conferences/exhibitions. The level of awareness and credibility vis-à-vis PR campaign created a perceived favorable image in the technical community and I was informed by a colleague at Lucas (who bought the company) that it was a significant factor in their selecting NovaSensor over several other MEMS companies that they were considering for acquisition at that time.

Si-Time…MEMS-based system timing products

Again, at Si-Time (Sunnyvale, California) with Kurt Petersen as CEO, Roger Grace Associates was selected as their i-MARCOM consultant and was provided with ample resources to create a spokesperson position for them in a very crowded market. This was a “perfect storm” scenario where we had an exceptionally advanced product, a large market and Dr. Kurt Petersen at the “helm”. (Kurt is a contributor to this tutorial series and is considered the “Father of MEMS” by many in the MEMS community). Some of the major victories of the PR campaign included the placement of six front-page stories in highly regarded international technical publications extolling the benefits of Silicon system timing products.

Our strategy was to educate and inform the target audiences of the product differentiation and inherent benefits of our Silicon-based MEMS solution versus a 50-year-old technology…crystals which dominated the market. In a very short period of time, we surpassed from an awareness and preference perspective several organizations that had beaten us to the market. As a result, we overtook them and became the “darlings” of the Silicon systems timing product market. We did not even have to mention how much better we were than the competition…and we significantly captured the media’s attention. This truly demonstrates how the proper allocation of resources and the ability to “stand above the crowd” from a technology perspective can pay off it big numbers by enhancing the valuation of the company during the acquisition process. For its Si-Time client, Roger Grace Associates planned and implemented an in-depth public relations campaign to achieve these results.

Both companies were acquired by larger firms and the key employees were rewarded handsomely. The integrated i-MARCOM programs, and especially the PR program, were instrumental in creating awareness and subsequent customer engagements for both companies and this was reflected directly in the enhanced valuations realized during the acquisition process. And to paraphrase Paul Werbaneth…. we achieved multiple means of engagement with the client visa-vis the media and virtually all of them free. And what is better than that? And to quote a long-time friend and MEMS pioneer, Dr. Paul Zavracky…” who is better than us?”. I strongly recommend that sensors/MEMS executives play close attention to these success stories and seriously consider adopting I-MARCOM into their marketing campaigns.

SUMMARY/CONCLUSIONS

In the early part of Episode 7, we did a follow-up on the basic problems associated with attempting to conduct accurate market research on emerging markets and recommended techniques to overcome these limitations and deficiencies. Market research firms were also challenged to provide historical results of their projection to assess their level of accuracy.

The later part of Episode 7 addressed the topic of i-MARCOM and its highly leveraged contribution in the marketing mix. We focused on how market research in the back-end of the sensors/MEMS commercialization process is a valuable tool to optimally plan the i-MARCOM campaign and provide the sensors/MEMS marketers with information on the competition to help formulate the positioning of the organization as part of the creation of the strategic messaging campaign. Case studies of two previous Roger Grace Associates MEMS clients, NovaSensor and Si-Time solidly demonstrated the high impact that well-planned and adequately resourced i-MARCOM campaign with a focus on PR can provide to an organization. This included the creation of exceptional value in establishing a defensible position of technology spokesperson in their respective technology sectors.

Additionally, the promotions campaign uncovered many new customers. Finally, it provided enhanced valuation to both organizations when they were sold as strategic investments to electronic industry leaders. Participation in trade shows/technical conferences also was a favorite of interviewees (and myself as well) as another highly leverage i-MARCOM tactic since it provides a myriad of opportunities to help promote the organizations products/services to their customer base as well as an ideal opportunity to meet editors…and which better venue to attend…you guessed it…Sensors Expo. I have been to over 30 of these events since the first one with NovaSensor (mentioned earlier) at the very first Sensors Expo where we exhibited and presented a paper.

The next, and final episode in this tutorial series will address the differences in marketing and selling into the sensors/MEMS industry with that of selling into the IC industry. I have been fortunate to have as colleagues, individuals that have significant experience in both and were forthright in their comments during our interview processes. Also provided will be a wrap-up of the series.

Finally, please be advised that I am scheduled to provide a webinar on the topic of Sensors and MEMS Marketing on February 13 at 1:00 p.m. Eastern. I encourage you to sign up for this information rich event. Please go to www.sensorsexpo.com to register.

ACKNOWLEDGEMENTS

The author would like to sincerely acknowledge the contributions of the following individuals who were interviewed for these episodes and who provided valuable and helpful information to their creation. Thank you all so very much. (The names provided are in alphabetical order by last name.)

Sandeep Akkaraju, President /eXo Imaging (Formerly: CMO Jyve)

Robert Andosca, Ph.D. CEO / Inviza (Formerly: CEO microGen)

Matt Apanius, President and Managing Director/ Smart Microsystems

Wilfried Bair, Senior Engineering Manager/NextFlex

Janusz Bryzek, Ph.D., CEO/eXo Imaging (Formerly: CEO Jyve)

Juan Figueroa, Ph.D. CEO/Abenaki Connect (Formerly: SBIR Program Manager/National Science Foundation)

Alyson Hartzell, Managing Engineer/Veryst

Brian Kinkade, Founder/Positive Impact (Formerly: Marketing and Sales VP, Spec Sensors)

Jim Knutti, Ph.D., CEO/Acuity Inc.

Mark Laich, CEO/Laich Advisory Group, (Formerly: VP Sales and Marketing/ MEMSIC and V.P. Business Development /Qualtre)

Keith Myers, V.P. Marketing/TE Connectivity

Tom Nguyen, CEO/Dun An Sensing

Rob O’Rielly, Consulting Engineer/Analog Devices

Rick Russell, President/Merit Medical

Steve Ohr, Semiconductor Industry Analyst and Reporter (Formerly: Semiconductor and Sensors Analyst/Gartner)

Kurt Petersen, Ph.D., Member/Silicon Valley Band of Angels (Formerly: CEO/SiTime)

Paul Pickering, V.P. Business Development/Micralyne

Swaminathan (Swami) Rajaraman…, Ph.D., Assistant Professor/University of Central Florida

Steve Walsh, Ph.D., Professor/University of New Mexico

Paul Werbaneth, Director of Marketing/Intervac

Steve Whalley, Whalley Consulting (Formerly: MEMS and Sensors Industry Group/Chief Strategy Officer)

Gary Winzeler, V.P. Sales and Marketing/Dun An Sensing

About the author

Roger H. Grace is president of Roger Grace Associates (RGA), a Naples Florida-based marketing consulting firm specializing in high technology, which he founded in 1982. His background includes over 40 years in analog circuit design engineering, manufacturing engineering, application engineering, project management, product marketing, and technology consulting. He can be reached at 239-596-8738, [email protected].