Safety, Surveillance And Infotainment

Networked cameras are seeing rapid adoption in several large and growing segments such as Automotive for advanced driver assistance systems (ADAS) and Digital Home & Industrial for surveillance and infotainment applications. These applications are characterized by the need for energy efficient, size and cost effective products with acceptable levels of Quality of Service (QoS) and emissions.

MARKETS: Driver Assistance And Safety

Advanced Driver Assistance Systems (ADAS) constitutes one of the fastest growing applications within the automotive market. Driven by government legislation and a desire for enhanced in-vehicle safety the camera sensor has become a key ingredient. By 2017, camera-based module sales are expected to increase to 34 million in total, up significantly from 6.1 million in 2010. This is in part due to the National Highway Traffic Safety Administration

(NHTSA) ruling requiring every car sold in the US from 2014 to be fitted with at least a single rear view camera or sensor. Such rulings will further accelerate demand with the need from automotive manufactures of more advanced multi-camera systems to provide differentiation in their mid and higher end models.

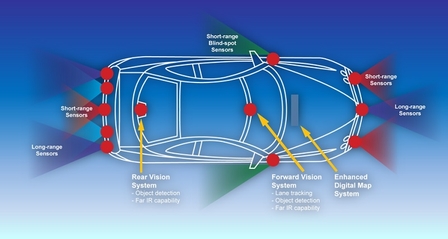

Rear view camera parking assistance is just one example of display-based vision systems, other applications include night vision, interior mirror replacement and 360-degree multi-camera view. Display-based vision systems rely on the driver to make informed decisions based on images or video received from camera sensors strategically positioned around the vehicle and displayed on a monitor (see figure 1).

Other applications, however, do not rely solely on driver decisions. Here, embedded control units (ECUs) within the car acquire and analyze sensor data and automatically control specific functions. Such applications, for example, lane departure, sign recognition and collision detection, are termed Machine-based vision systems.

The automotive market is quickly moving towards the Smart Car, requiring smart cameras to detect, recognize, analyze and react. As a consequence, demand for vehicle bus bandwidth increases and cost effective solutions grow. Proprietary methods are making way for common open network standards, offering ample bus bandwidth, while lowering overall Cost Of Ownership (COO).

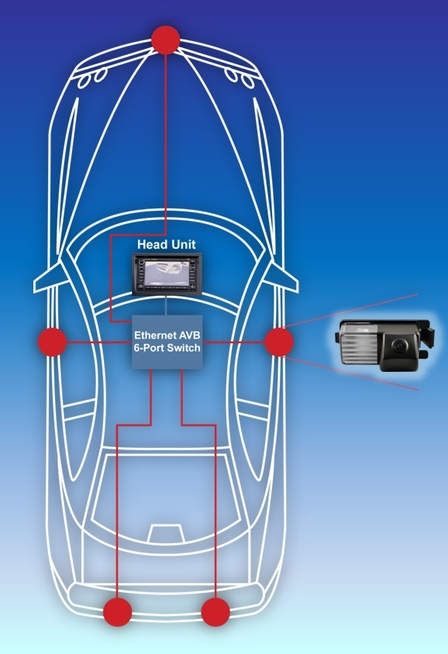

Ethernet is the unquestionable physical layer choice of any such network, reflected in ISO 17215, Video Communication Interface for Cameras (VCIC) specification, defining Ethernet connectivity for vehicle cameras/sensors. Figure 2 shows an example of a 360° multi-camera Ethernet-based network. With an increased demand on the accuracy and quality of the sensed images for system and the need for a driver to react and make smart decisions, image processing has become integral part of the system. This increased power demand on the processors have added additional burden on the camera module providers in maintaining the performance of the system under extreme temperatures and challenging space constraints.

Fig. 2. Multi-camera Ethernet car.

Building management, like one has seen with cars, is also becoming smart. Surveillance systems continue to advance with remote management and monitoring, improved image quality from standard to high definition and smart sensor features, such as automatic people and facial recognition. Around 40 percent of surveillance cameras today are networked, with this expected rise to more than 60 percent by 2016.

Facial and people recognition provides enhanced levels of surveillance over traditional motion detection and video recording, with the ability to analyze and react in real time. For security systems, this provides a means to classify the object prior to raising any alarm, eliminating false alarms, presently a common occurrence. Facial recognition can provide further intelligence by determining if a person is truly an intruder or not

People recognition and counting can also be utilized in smart building management to control lighting, air conditioning and entry access. Other emerging smart camera markets for people counting and recognition include public advertising and digital signage.

The trend towards Ethernet based surveillance networking ensures continued growth for the key element, the IP camera (25 to 30 percent CAGR). IP camera networks provide key advantages over traditional CCTV cameras by leveraging existing data networks, removing the need for additional single-purpose proprietary camera network and lowering cost by using Power-Over-Ethernet (PoE) to simultaneously transfer both power and data. Now multiple applications and services can be transported over a common single infrastructure, offer remote access and lower operational costs.

achieve within the required size, power and cost constraints.

In Part Two we will look at Infotainment applications