Most of the acquisitions we report on in the tech community have diversification as the end goal of the deal. For example, a large and established LED maker may acquire, or at least partner with, a maker of flat-panel displays to get a piece of the LED-TV/Display market.

Or a large manufacturer of connectors believes it could profit highly by adding cabinets and enclosures, insulation materials, and assembly and installation tools to its repertoire. Rather than investing heavily for tooling up shop, hiring and training new personnel, and promoting new ventures, it would make good sense to acquire a company or three that specializes in these value-added technologies. These satellite entities are already setup to produce product, they have the expertise from the ground up, and, most likely, have a solid reputation for producing excellent product.

Not a rarity, just a bit of a scarcity, are instances where a major company will divest itself of some of its reputable and profitable departments with the goal of focusing on a singular product rather than diversification. A stellar example is ams AG. Recently the company has been on crusade of acquisitions and divestitures in order to better focus on developing innovative sensors and providing support for them.

Kicking off June of 2016, ams acquired Cambridge CMOS Sensors Ltd (CCMOSS), considered a leader in micro hotplate structures for gas sensing and infrared applications. The acquisition signals ams as becoming a kingpin in CMOS-based gas sensing and infrared sensing for automotive, industrial, medical, and consumer applications. CCMOSS’ MEMS-based micro hotplates find employment in gas sensors for volume applications. CCMOSS’ manufactures these MEMS structures on CMOS wafers, creating monolithically integrated CMOS sensor ICs.

CCMOSS also has an impressive portfolio of high performance IR radiation sources and detectors for sensor applications. This will obviously expand ams’ spectral sensing strategy for next generation optical sensor technologies.

At the end of July 2016, ams AG signed an agreement to divest its NFC and RFID reader IP, technologies and product lines to STMicroelectronics. As per the company, the goal of this action is to further ams on its path to being a leading worldwide provider of sensor solutions. However, ams will not be completely out of the NFC/RFID game. It has retained its sensor-related NFC/RFID tags business and relevant design capabilities to create wireless IoT sensor solutions and support future sensor nodes.

Further clarifying the company’s sensor strategy, ams AG CEO Alexander Everke said of the transaction, “Divesting certain RFID/NFC product lines streamlines our product and technology portfolio around our core sensor solutions competence while maximizing the value of our high performance wireless IP. We are dedicated to actively managing our technology portfolio and focus on the most relevant opportunities driving our sensor solutions strategy forward.”

Also around the end of July of this year, ams further expanded on its goals by acquiring NXP Semiconductor’s advanced CMOS sensor business. This will give the company unimpeded inroads to highly lucrative smart phone, wearables, smart home, industrial, medical, and automotive markets.

Essentially, this acquisition extends ams’ environmental sensor portfolio with both monolithic and integrated CMOS sensors that measure variables such as relative humidity, pressure, and temperature in one sensor device. Thomas Riener, Executive Vice President, Marketing & Strategy at ams sees the acquisition as a synergistic addition to the company’s chemical sensor capabilities and smart lighting solutions that will make ams the one-stop shop for environmental sensors.

Saying ams was busy in July 2016 would be a slight understatement. The company also acquired color and spectral sensing specialist MAZeT to further extend its position in the optical sensing arena. Specializing in medical and industrial applications, MAZeT’s expertise covers IC and filter design plus hardware and software system development. Its JENCOLOR sensors are currently deployed in airplane interior lighting, agricultural, and medical skin lesion analysis applications.

As per Thomas Riener, EVP & General Manager Emerging Sensor Solutions at ams, “MAZeT’s excellent optical know-how allows us to create new product and application opportunities in areas such as sensing and controlling lighting, measuring physical parameters or matching colors on a display to the real world. ams’ operational and manufacturing capabilities and global sales reach will offer additional synergies increasing the strategic potential of this transaction.”

Creating exceptional sensors is nothing new to ams. The company has been around for quite a while with a solid foothold in the semiconductor space. What is new is its movement from making sensors and other semis to a full-on focus on sensors. In a meeting in July of this year, ams CEO Alexander Everke affirmed the company’s goal of having all the bases covered in sensor technology.

For one of the largest tech companies in the sensor arena, this makes (no pun intended) perfect sense. When it’s clear that sensors are major components in the design of every piece of technology coming down the pike (even the kitchen sink), a clear focus is not only smart; it’s essential.

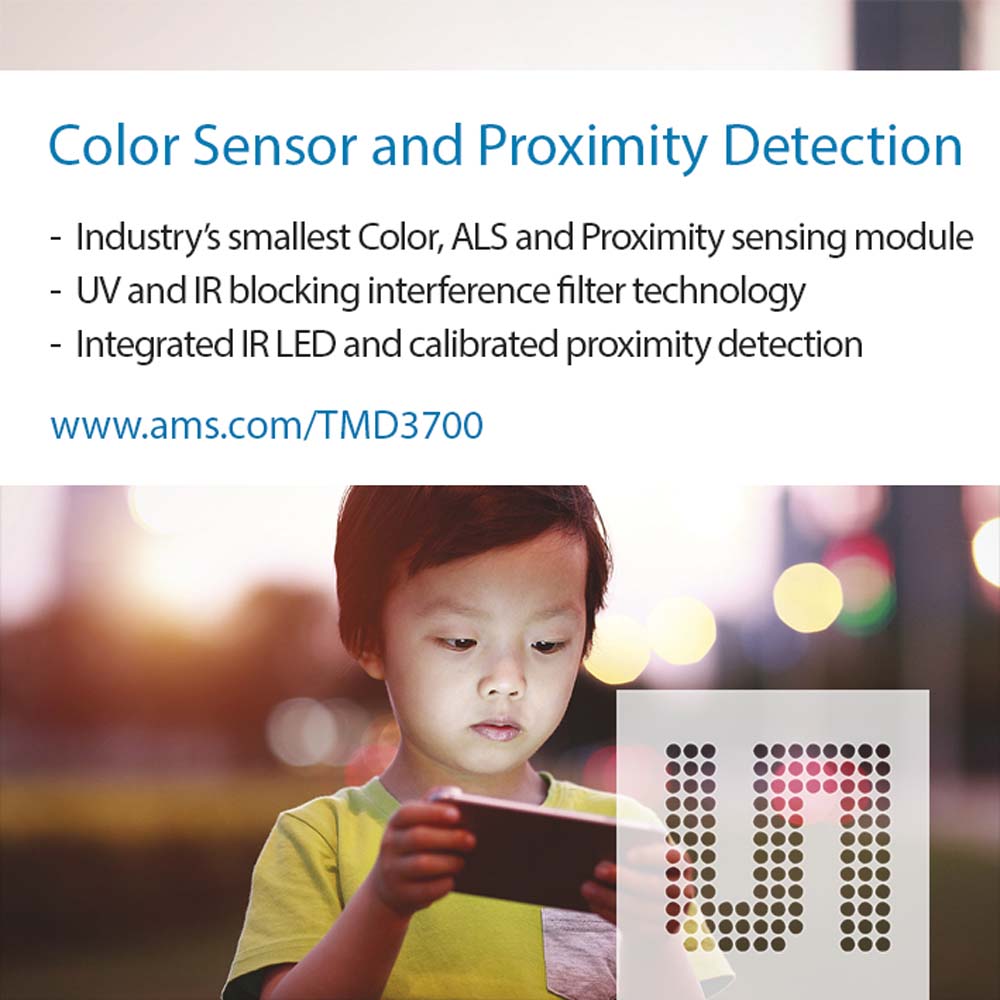

And a clear focus leads to innovative thinking and imagination. For example, on August 2, 2016, ams unveiled the market’s smallest optical sensor module for color (RGB), ambient light, and proximity sensing applications. The TMD3700 measures 4 mm x 1.75 mm with a height of 1 mm and features a 45° field-of-view, ambient light sensing accuracy of ±10%, and an operating range of 200 mlux to 60 Klux behind dark glass.

The color sensor channels each have UV and IR blocking filters and a dedicated converter allowing simultaneous data capture. Other features include dynamic elimination of both electrical and optical crosstalk and an integrated IR LED calibrated for maximum performance and consistent operation. The TMD3700 is available now, priced at $1.10 each/1,000. For more information, CLICK HERE.

Also in the aforementioned meeting with Alexander Everke, he made it clear that when you focus on sensors, the needs of the designer are met quickly and without the problems associated with over extended diversity. For example, the sensor maker needs to know the sensor type, size, accuracy, and durability. External issues beyond that, i.e., security, software, interface, and standards, are the concern of third parties and not the sensor maker. As I said, it makes good sense.

What also makes good sense is attending Sensors Expo Midwest where you will see every and all sensor technologies under one roof. Be sure to register soon before the mad rush, just ask anyone who was at Sensors Expo in San Jose in June. There were no unhappy campers. ~MD